20 Back-to-School Hacks So You Can Beat Inflation

Back-to-School Hacks to Beat Inflation

Back-to-school season is here, and this year, the second-biggest shopping season of the year will be more expensive than ever. With inflation still at all-time highs, the supplies and gear you always buy may cost a lot more than you paid just a year or two ago. No worries, though. There are still ways to trim your back-to-school spending and keep your budget intact. Here are 10 back-to-school hacks for beating inflation.

1. Set a Budget and Stick to It

Create a realistic budget for your back-to-school shopping and stick to it. Make a list of essential items and allocate a specific amount for each category, such as clothing, supplies, and electronics. Make sure your budget is generous enough to cover all purchases but tight enough to not end in debt. This will help you avoid impulse purchases and stay within your financial limits.

2. Start Early and Plan Ahead

One of the best ways to save money is to start shopping early. This will enable you to take advantage of sales and avoid the last-minute rush when prices may be higher. For example, you can pick up pencils when they’re on sale at Walmart one week and paper from Target when it is marked down there. Spreading your purchases over time will also make it easier on the budget.

3. Take Inventory of What You Already Have

Before heading to the stores, check out the inventory of supplies and clothes you already have at home. Often, last year’s items can be reused or repurposed. Check closets, drawers, storage bins, and last year’s backpacks for notebooks, pens, pencils, and other supplies. This can help you avoid buying more of what you already have and save a significant amount of money.

4. Shop During Tax-Free Holidays

Many states also offer tax-free holidays, where certain items are exempt from sales tax. Plan your shopping around these dates to maximize your savings. Combine sales with coupons or loyalty programs for even better deals.

5. Buy in Bulk

For items you’ll need to buy many of, like notebooks, pens, and paper, buying them in bulk can be more cost-effective than traditional shopping. You can generally find discounts on bulk purchases at warehouse stores and office supply retailers. To save even more, you can team up with other parents and split the costs.

6. Use Price Comparison Tools

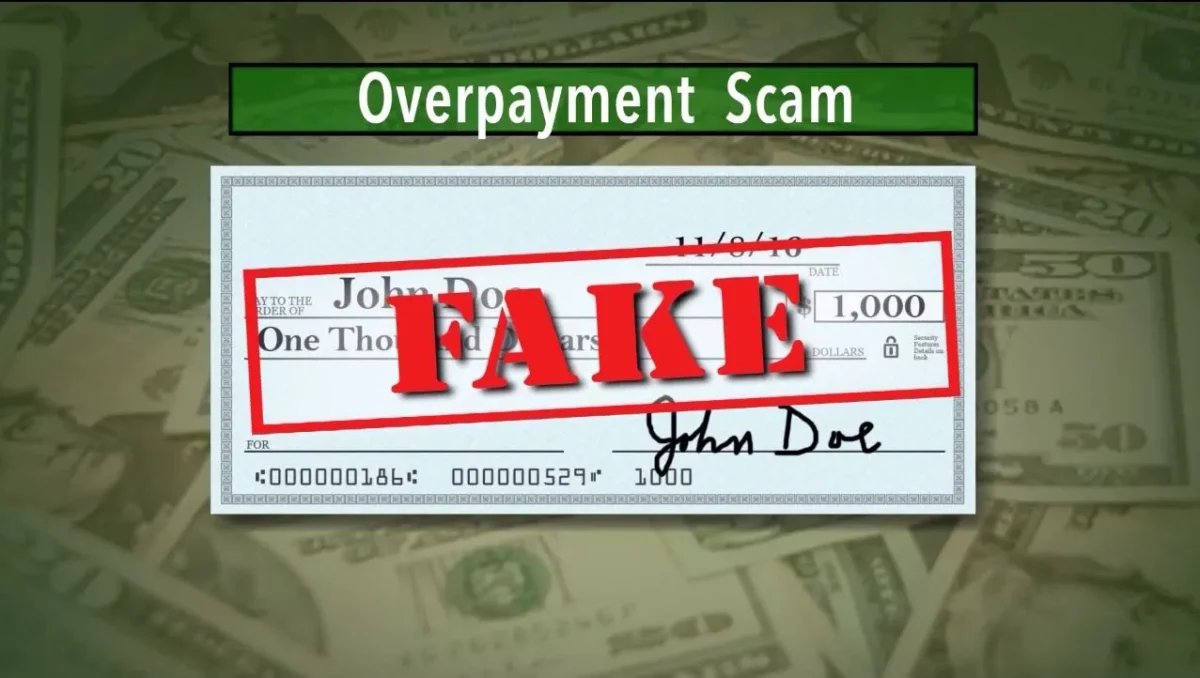

Harness the power of technology to find the best deals as you shop for school supplies, gear, and clothing this season. A price-comparison website or app, like Honey or RetailMeNot, will automatically compare prices across different retailers to find you the best deal. Many will also find promo codes and coupons for you so steeper discounts can be had.

7. Consider Secondhand Options

Thrift stores, consignment shops, and online marketplaces, like eBay and Facebook Marketplace, can be treasure troves for gently used clothing, backpacks, and other school supplies. Check out these places for high-quality items at a fraction of the cost of new ones. For textbooks, check out websites, like Chegg or ThriftBooks, for used or rental options.

8. Choose Quality Over Quantity

While it might be tempting to buy the cheapest option available, investing in high-quality items can be the least costly choice in the long run. Durable backpacks, sturdy shoes, and long-lasting electronics might have higher upfront costs, but they will likely outlive their less-expensive counterparts and save you money over time.

9. Take Advantage of Student Discounts

Many retailers offer student discounts on a variety of items, from clothing to electronics. Check out the sites of your favorite retailers to see what they offer before completing a purchase. Don’t shy away from asking about possible student discounts in real-life stores, either. You may need to provide a student ID or use a promo code to access these discounts, but you can walk away with significant savings.

10. Leverage Cashback and Rewards Programs

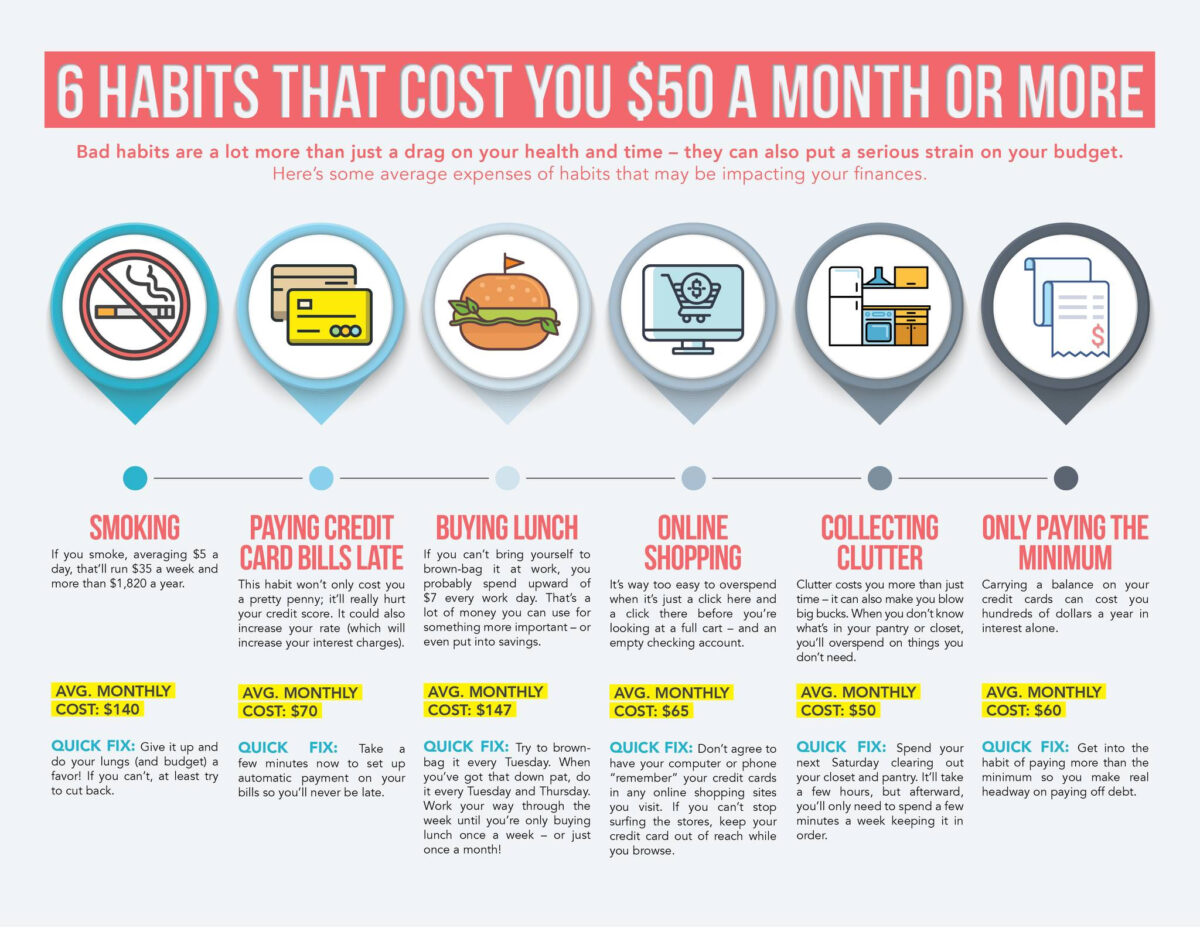

You may want to use credit cards that offer cashback or rewards on purchases to get a little extra back for your spending. Only do this if you know you can pay off the credit card bill in full soon after. Otherwise, the interest charges you’ll be paying going forward will likely offset any benefits you may enjoy.

11. Utilize Cashback and Rewards Programs

Many credit cards offer cashback or rewards points for purchases. Use these programs to your advantage by paying for back-to-school items with a card that provides rewards. Just be sure to pay off the balance in full to avoid interest charges.

12. Take Advantage of Buy-One-Get-One-Free (BOGO) Deals

Keep an eye out for BOGO deals on school supplies and clothing. These offers can significantly reduce your overall spending, especially if you have multiple children to shop for.

13. Use Student Loan Programs for Technology Purchases

If your child needs a new laptop or tablet for school, look into student loan programs that offer low-interest rates or deferred payment plans for technology purchases.

14. Participate in Store Loyalty Programs

Many retailers offer loyalty programs that provide exclusive discounts, points on purchases, and special promotions. Sign up for these programs to maximize your savings.

15. Swap and Share with Other Parents

Organize a swap meet with other parents to trade gently used school supplies, clothing, and gear. This can be a fun way to get what you need while saving money and reducing waste.

16. DIY When Possible

Consider making some of your school supplies at home. For example, you can create customized notebooks, binders, and pencil cases with inexpensive materials. This not only saves money but also adds a personal touch to your child’s items.

17. Seek Out Coupons and Rebates

Before making any purchases, search for coupons and rebates. Websites like Coupons.com, RetailMeNot, and manufacturer websites often have printable coupons and rebate offers that can save you money.

18. Utilize School Supply Drives and Donations

Check with local community organizations, schools, and churches for school supply drives. Many organizations offer free supplies to families in need. Take advantage of these resources to reduce your back-to-school expenses.

19. Use Cashback Websites

When shopping online, use cashback websites like Rakuten or Swagbucks. These platforms give you a percentage of your purchase back as cash or rewards points, which can add up over time.

20. Plan for Next Year

Start planning for next year’s back-to-school shopping as soon as this season ends. Take advantage of end-of-season sales and clearance events to stock up on supplies and clothing at deeply discounted prices.

Incorporating these additional tips will help ensure your back-to-school shopping is as cost-effective as possible, allowing you to beat inflation and stay within your budget.

Banking With A Purpose

Much more than a catchphrase, our tagline is our passion, our reason why we do what we do. This is the impact of your membership with AGCU.

Learn More About Banking with a Purpose