12 Steps to Financial Wellness-Step 3: Pay Down Debt

12 Steps to Financial Wellness

Step 3: Pay Down Debt

You’ve tracked your spending, designed a budget for your monthly expenses, and you’re on a good path to financial wellness. In this next step, you’ll create a plan for paying down debt.

Consumer debt can be one of the biggest challenges to financial wellness. With some intentional action and commitment, reaching true financial wellness is possible.

Here’s how to pay down or off your debt in five simple steps.

-

Organize your debt

List every credit card you own along with an outstanding balance. Jot down the amount owed to each card issuer. Next, list the interest rate of each card. Repeat these steps for other loans you may have as well.

-

Choose your debt-crushing method

There are two approaches generally advised to folks who are seeking to get rid of their debt:

-

The snowball method involves paying off your smallest debt first, and then moving to the next-smallest until all debts have been fully paid.

-

The avalanche method involves getting rid of the debt that has the highest interest rate first before moving on to the debt with the next-highest rate until all debts are paid.

Choose the method that makes the most sense for your personal and financial circumstances.

-

Maximize your payments

Once you’ve chosen your debt-crushing method, find ways to maximize your monthly payments. You can do this by trimming your spending in one budget category and channeling that money toward your debt. You can also find ways to get some extra cash for your payments, such as freelancing for hire.

-

Consider a debt consolidation loan

When you consolidate debts to one low-interest loan, it’s a lot easier to manage the monthly payments. Plus, the savings in interest you won’t pay can be significant, especially if the new loan has a low-interest rate. If this approach sounds right for you, consider taking out a personal loan.

-

Negotiate with your creditors

Many credit card companies will be willing to lower your interest rate once you prove you are serious about paying down debt. After kicking off your debt payment plan, it’s worthwhile to contact each credit card company to discuss options.

No matter which strategy you go with or the methods you use for paying off your debt, commit to not adding more debt onto your card while paying it down. Paying off a large amount of debt will take time and willpower, but living debt-free is key to financial wellness. Best of luck on your debt-crushing journey!

Read Step 1: How to Track Your Spending

Read Step 2: Creating a Budget

Read Step 4: Have the Money Talk With Your Partner

Read Step 5: Practice Mindful Spending

Read Step 7: How to Pay Yourself First

Read Step 8: Know When and How to Indulge

Read Step 9: Build and Maintain an Excellent Credit Score

Read Step 10: Plan for Retirement

Read Step 12: Review and Tweak

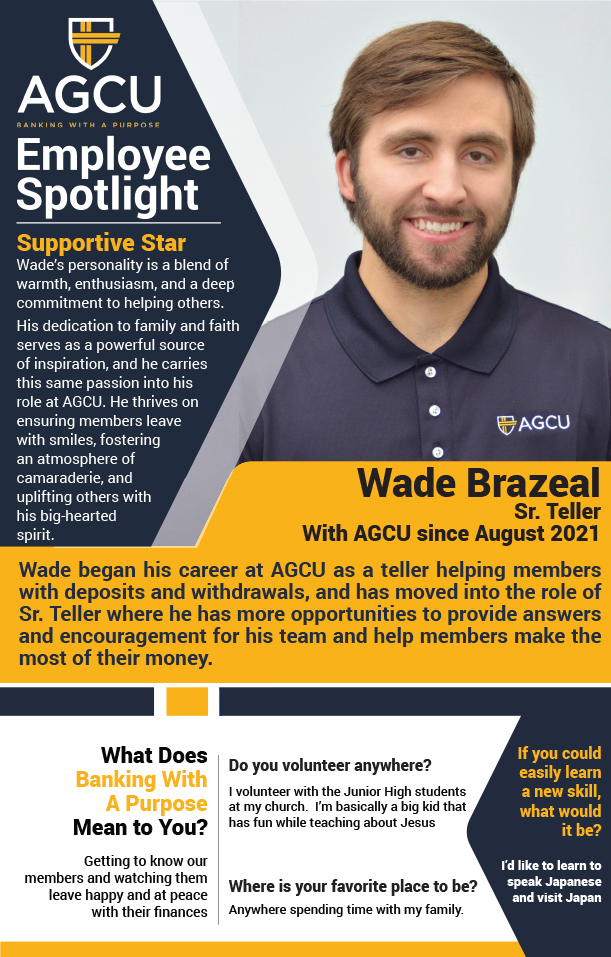

Banking With A Purpose

Much more than a catchphrase, our tagline is our passion, our reason why we do what we do. This is the impact of your membership with AGCU.

Learn More About Banking with a Purpose

AGCU shares your values and faith. We provide individuals, ministries, and businesses with the financial tools and knowledge they need to grow and thrive financially so they can transform our world through their generosity.

AGCU shares your values and faith. We provide individuals, ministries, and businesses with the financial tools and knowledge they need to grow and thrive financially so they can transform our world through their generosity.

Convoy of Hope

Convoy of Hope

Education: Nurturing Minds, Building Futures

Education: Nurturing Minds, Building Futures Project Rescue

Project Rescue YiPoA – Youth in Pursuit of Awakening

YiPoA – Youth in Pursuit of Awakening Fellowship of Christian Athletes

Fellowship of Christian Athletes REVFresh

REVFresh Springfield Giants

Springfield Giants Simply Loved Orphan Care

Simply Loved Orphan Care Light The Way Ministry

Light The Way Ministry The Young Entrepreneurs Showcase

The Young Entrepreneurs Showcase

Top 5 Reasons to Choose AGCU

Top 5 Reasons to Choose AGCU Competitive Rates on Your Deposits

Competitive Rates on Your Deposits We’re All in This Together

We’re All in This Together We Get You

We Get You Your Money, Your Way

Your Money, Your Way A Faithful Legacy

A Faithful Legacy