Take The 2023 America Saves Pledge

A common question we hear across the industry when it comes to saving… How do you save for so many things at once?

One of the most overwhelming parts of saving for everyday Americans is balancing saving for so many competing priorities.

Not only do they need to save for short-term emergencies and opportunities, but also for future and long-term goals. Those long-term goals include major milestones like education, homeownership, and retirement.

2023 America Saves Week

Saving at Any Age | Friday, March 3, 2023

SAVING AT ANY AGE

Saving. Do you view it as an ongoing journey? Or do you consider saving as someplace you arrive at? At America Saves we are in the camp that saving is a habit, not a destination. And it’s a habit that can be formed at any age. Whether you are a parent trying to instill this habit in your children or you want to change your own saving behaviors, there are strategies that savers of all ages can develop.

Saving. Do you view it as an ongoing journey? Or do you consider saving as someplace you arrive at? At America Saves we are in the camp that saving is a habit, not a destination. And it’s a habit that can be formed at any age. Whether you are a parent trying to instill this habit in your children or you want to change your own saving behaviors, there are strategies that savers of all ages can develop.

Research tells us that children’s money habits are often formed by age seven so starting early to teach them about saving can have a huge impact. Many parents are accustomed to hearing frequent requests from their children about a toy, game, or piece of clothing that they “just have to have.” Sound familiar? Using these wants is a great way to help children learn to save.

Children can learn to set a saving goal and figure out how long it will take to save enough money for their goal. Create a fun system to track progress, provide regular encouragement, and use incentives such as matching funds. Talk about how it feels to see your money grow. And don’t forget to lead by example – show children how you are saving.

You can also give children the opportunity to make some decisions about their money. Empowering children from a young age to make choices about money they earn or receive as gifts is a great way to build that confidence.

For young adults, as they begin to earn a regular and potentially higher income, a strong foundation begins with basic understanding of the difference between needs and wants. The America Saves Spending and Saving Tool is an easy-to-use resource that provides a clear view of your finances and can be insightful in identifying essential and discretionary spending. The system of automatic saving, especially through paychecks with split deposit, can set young adults on the path to a lifelong saving habit.

It can be hard to stay motivated when setting aside money for something in the future no matter what your age. It’s easy to focus on what you want in the moment — we don’t want to wait to purchase that expensive pair of sneakers. We want to take a trip in the next three months. Retirement is so far off that it feels OK to spend more of your current income right now and catch up later. In each of these scenarios, we aren’t thinking about our future selves, just who we are and what we want today.

Thinking of our future self – what we will want, what we will be doing, what we will believe – is one way we can develop a saving mindset. Asking questions about our future selves helps us create a vision for our future. For example, consider:

- Where does your future self live?

- What does a typical day look like for your future?

- What hobbies does your future self enjoy?

- How much money does your future self earn?

Later go back and read your answers to see how they compare to the present. Having the ability to look ahead, even if it’s a short time in the future, is a great way to reinforce saving today for tomorrow. This exercise can be done at any age, even with children.

Journeys can take us on many different paths and saving journeys are no different. So stay with America Saves as you and your family embark on a new journey or resume one that encountered a detour. It’s never too late to #ThinkLikeASaver.

2023 America Saves Week

Paying Down Debt Is Saving | Thursday, March 2, 2023

PAYING DOWN DEBT IS SAVING

Making the decision to pay down debt, particularly consumer debt, can be mixed with emotion. You feel good about choosing to take concrete steps to pay off balances on credit cards, auto loans,student loans or other installment loans. On the other hand, you feel less positive about the amount of money you are directing into a savings account. Well, we’re here to show you how reducing debt is a form of saving, to give you strategies for the best way to do so that align with your personal situation, and to boost your financial confidence to keep you working toward your goals.

As you pay off your debt you are freeing up money, allowing you to direct those funds toward saving for something else that’s important to you – perhaps an emergency/opportunity fund, a vacation, home purchase, or retirement. This money is freed up as you spend less on interest, and possibly late fees, and lowering the debt balances themselves.

If you have more than one debt you want to pay off, for example an auto loan and a credit card balance, there are two main strategies to help you decide which debt to pay off first.

- The snowball method focuses on the balances of each loan. In this strategy, you make the minimum payment on all your loans except the one with the smallest balance. With this loan, you put as much money as you can toward it and when it is completely reduced you allocate that money to the next smallest balance. Your confidence gets a boost every time you see an account balance at zero.

- The avalanche method focuses on the interest rates of each loan. In this strategy, you pay the minimum payment on all your loans except the one with the highest interest rate. You apply any remaining money you have for debt repayment to the highest interest rate loan. By paying off the debt with the highest interest rate first you reduce the overall amount of interest you must pay.

You choose which method is right for you and your situation.

Once you are on a path to reducing your debt, reflect on the type of relationship you have with credit. Credit is a tool. When used wisely and with purpose, credit can help you achieve your financial goals and build financial confidence. Having a clear view on when and for what purpose you use credit is the foundation for a positive relationship.

Sometimes we’re told there are good types of debt (home mortgage) and bad debt (credit cards). This type of categorization is based only on the financial aspect and not the personal situation you are dealing with. It may feel better to ask yourself if the type of debt you are taking on is a good decision for you or not.

For example, when an emergency expense crops up, and it is large enough that it will deplete all or nearly all of your emergency savings, you may feel like you’re on shaky ground if another expense crops up before you can replenish your savings. So, you may weigh this option against using a combination of savings and credit based on what feels best for you in the situation.

Making purposeful choices about credit, something that you plan for financially and mentally can help you build more financial confidence.

2023 America Saves Week

Saving For Major Milestones | Wednesday, March 1, 2023

SAVING FOR MAJOR MILESTONES

What do homes, education, and retirement all have in common? They are major life milestones that require advance planning and saving large amounts of money. That amount of advance planning and money saved that is needed may make you doubt your ability to reach these goals. Even if you don’t feel that way today, you may have in the past or may in the future.

The good news is that there are ways to plan and save for these major milestones in a way that aligns with your values and current life situation and still sets you up for success. Keep in mind:

- Make a plan for how much you need to save and when you want to have that money saved. The America Saves Pledge and the Spending and Saving Tool are both resources that can help with your planning.

- Whenever you have more than one goal that you are working on at the same time, it’s important to prioritize them. Yes, you can save for retirement and education or retirement and home ownership at the same time. You just may need to allocate a greater percentage of your available money to save more for one goal over another.

- You get to decide which goal is the most important to you right now and you can use that decision to guide your plans. And this can change over time.

- When tough times happen, and they will at some point, it’s OK to set aside some saving goals. If you lose your job, you may need to forgo continuing to save for your retirement and child’s education until you find a new job.

- Do your research. Having the right information for your personal circumstances can help you more confidently plan and execute that plan.

- With retirement, you want to understand what savings vehicles you have access to through your employer before seeking resources for individual accounts. You also want to have a reliable calculation for the money you need saved and what the best investment options are for you.

- With home purchases it’s important to have an idea of the type of house you want and in what area so you can research prices. You also want to know your credit score to understand what types of mortgage rates you can qualify for.

- When saving for education, 529 College Saving Plans are one of the best options available as the money grows tax free and is not taxed when withdrawn if it is used for qualified expenses.

- With any of these goals, utilize automatic saving vehicles wherever possible. Typically, employer defined contribution retirement plans use automatic deductions from your paycheck. You can also direct an investment company or your financial institution to set aside money each month for retirement, home down payment or education accounts.

With all these goals, while the sooner you can start saving for them the less you will have to save each month, recognize that your situation will determine when you are able to start saving. Delaying when saving for education may mean you need to take out more in loans. Delaying saving for home ownership or retirement may mean you have to wait longer to buy a house or work longer before you retire. These are your choices to make.

Confidence comes with knowing you have done your research, consulted with professionals, examined your current situation, made some predictions for future saving opportunities, and recognized that as life unfolds you can adjust your plans.

2023 America Saves Week

Saving For The Unexpected | Tuesday, February 28, 2023

SAVING FOR THE UNEXPECTED

How often have you heard that saving for life’s unexpected events is very important and a necessary part of being financially prepared? Most likely A LOT!Accompanying this message often is the statement that you need three to six months of expenses in your emergency savings account.

For those of us who struggle with saving for the unexpected or are saving but don’t have that three to six months amount accumulated, our confidence might be shaken because we haven’t met this standard. And when we lack confidence, it can be even harder to get or stay motivated to save for those unexpected events or opportunities that arise.

Instead of focusing on what you haven’t accomplished, here are a few strategies to consider that may help you build your financial confidence and begin or continue on your path to saving for the unexpected.

- Set a goal of saving $500 for emergencies and once you reach this amount, set a new goal for another $500 and keep going. Reaching several smaller goals feels good and when we feel good, we’re more likely to remain committed to our plan.

- If you’re not sure exactly how much you can realistically save each month, try using the America Saves Spending and Saving Tool to get a clear view of your finances. Once you know exactly what your income and expenses are, you will be able to set a realistic timeframe for saving that first $500 or beyond.

- Consistency can help build confidence. Saving automatically every time you get paid is the easiest way to be a consistent saver, and consistency builds confidence. You can set up split deposit saving with your employer or your financial institution so that a portion of every paycheck goes directly into a dedicated savings account. When you are saving $10, $20, or some other amount every paycheck, you will see regular progress, building your confidence along the way.

- Instead of only focusing on the negative reasons for having an emergency savings account, think of it as saving for opportunities. Framing the reason you are saving in a more positive light may help you feel better about setting money aside. Not only are you saving to pay for car repairs, home expenses, or medical bills, tell yourself you are saving for an unplanned dinner out to celebrate a friend’s birthday or the chance to go see your favorite artist in concert. Those positive feelings can be motivating.

- Use the three to six months of expenses in a savings account as a guideline. Try not to become discouraged if you haven’t met this level. Instead, focus on what makes the most sense for you at this time, knowing that as your income grows and/or expenses decrease, your ability to save more and more quickly will change.

America Saves is here to help you get started on any of these strategies. Check out the 6 Steps to Establishing a Spending and Savings plan, take the America Saves Pledge, or listen to our Think Like A Saver podcast. We’re with you every step of the way on your savings journey.

2023 America Saves Week

Saving Automatically | Monday, February 27, 2023

Do you ever find yourself wondering if there is a magic formula to saving

Does it seem that everyone around you knows the secret to saving successfully except you? It’s not unusual to feel unconfident about saving, no matter how much money you earn. Confidence doesn’t necessarily come with having a lot of money. Rather it comes from building healthy financial habits and using the resources you know are available to you – this is your financial confidence!

A great place to start building your financial confidence is to set up automatic savings. When you are saving a dedicated amount of money every week, every month, or on some other regular interval, you can begin to feel a sense of control over your saving habits. Whether you are saving just $5 or $10 a month or more, it’s the fact that you’re doing it automatically that is important.

Saving automatically is the formula for successful saving for anyone – including you. Getting started doesn’t have to be a hurdle either. Consider which one of the following two strategies would work best for you and follow the steps we’ve outlined.

1. Instructing your employer to split your directly deposited paycheck into two or more accounts at your financial institution with one account being a dedicated savings account.

2. Directing your financial institution to automatically transfer money into your savings account.

For option #1, contact your employer’s payroll department to set up split deposit, telling them how much you want to save per paycheck, and follow their instructions.

If you want to use option #2, contact your bank or credit union telling them when and how much money you want automatically transferred into your savings account.

By utilizing either of these automated saving methods you can feel confident about building a healthy habit of saving. Imagine how good it will feel to see money accumulating in your savings account on a consistent basis. Instead of that voice in your head telling you that saving is hard, you’ll be able to say with confidence, “I am saving regularly!”

America Saves has a number of resources that can help you get started saving automatically:

- The Spending and Saving Tool to help you get a clear view of your finances and determine a realistic amount you can save regularly

- ThinkLikeASaver podcast where you can learn about making saving easier, saving in spite of inflation and many other topics designed to support your saving habit.

- The America Saves Pledge, which can help you make a saving plan and receive ongoing support through emails and text messages

So, remember your unique financial situation calls for you to make the choices that will work best for you and your family, which will ultimately increase your financial confidence and help you continue making informed choices throughout your saving journey!

Banking With A Purpose

Much more than a catchphrase, our tagline is our passion, our reason why we do what we do. This is the impact of your membership with AGCU.

Learn More About Banking with a Purpose

More articles

Like us on Facebook!

No matter your age, budgeting is a crucial aspect of managing your finances. By creating a budget, you can keep track of your income and expenses even if you don’t have that much income.

No matter your age, budgeting is a crucial aspect of managing your finances. By creating a budget, you can keep track of your income and expenses even if you don’t have that much income.

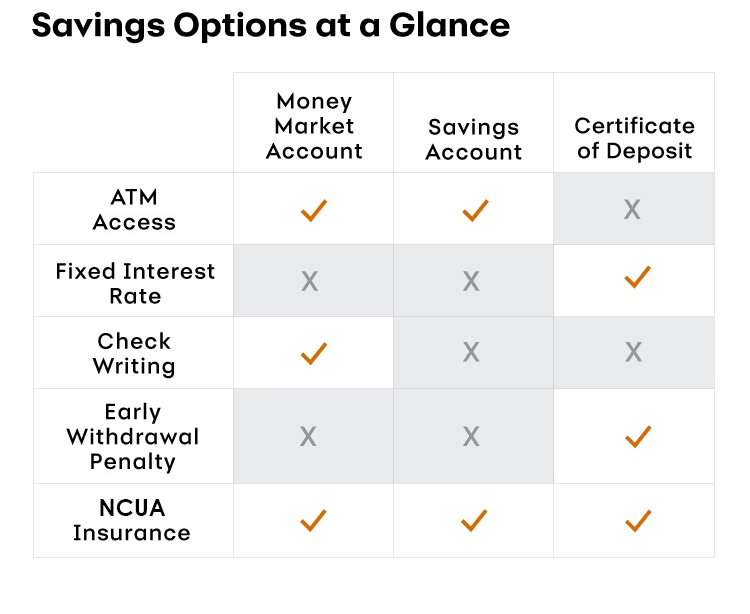

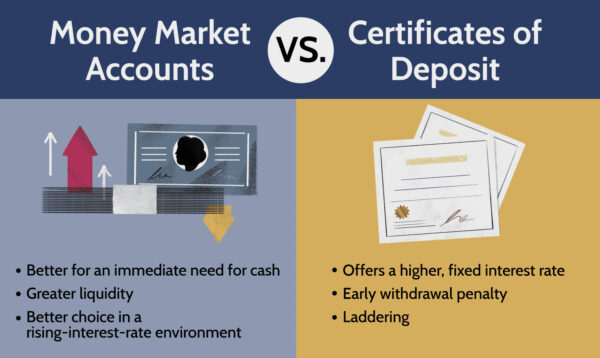

Shopping around for the best savings account can make a significant impact on your financial well-being. With inflation nibbling at our budgets, finding an account that offers decent returns has become more crucial than ever. Certificates of Deposit (CDs) and money market accounts are two alternatives to traditional savings accounts that offer higher

Shopping around for the best savings account can make a significant impact on your financial well-being. With inflation nibbling at our budgets, finding an account that offers decent returns has become more crucial than ever. Certificates of Deposit (CDs) and money market accounts are two alternatives to traditional savings accounts that offer higher

Saving. Do you view it as an ongoing journey? Or do you consider saving as someplace you arrive at? At America Saves we are in the camp that saving is a habit, not a destination. And it’s a habit that can be formed at any age. Whether you are a parent trying to instill this habit in your children or you want to change your own saving behaviors, there are strategies that savers of all ages can develop.

Saving. Do you view it as an ongoing journey? Or do you consider saving as someplace you arrive at? At America Saves we are in the camp that saving is a habit, not a destination. And it’s a habit that can be formed at any age. Whether you are a parent trying to instill this habit in your children or you want to change your own saving behaviors, there are strategies that savers of all ages can develop.