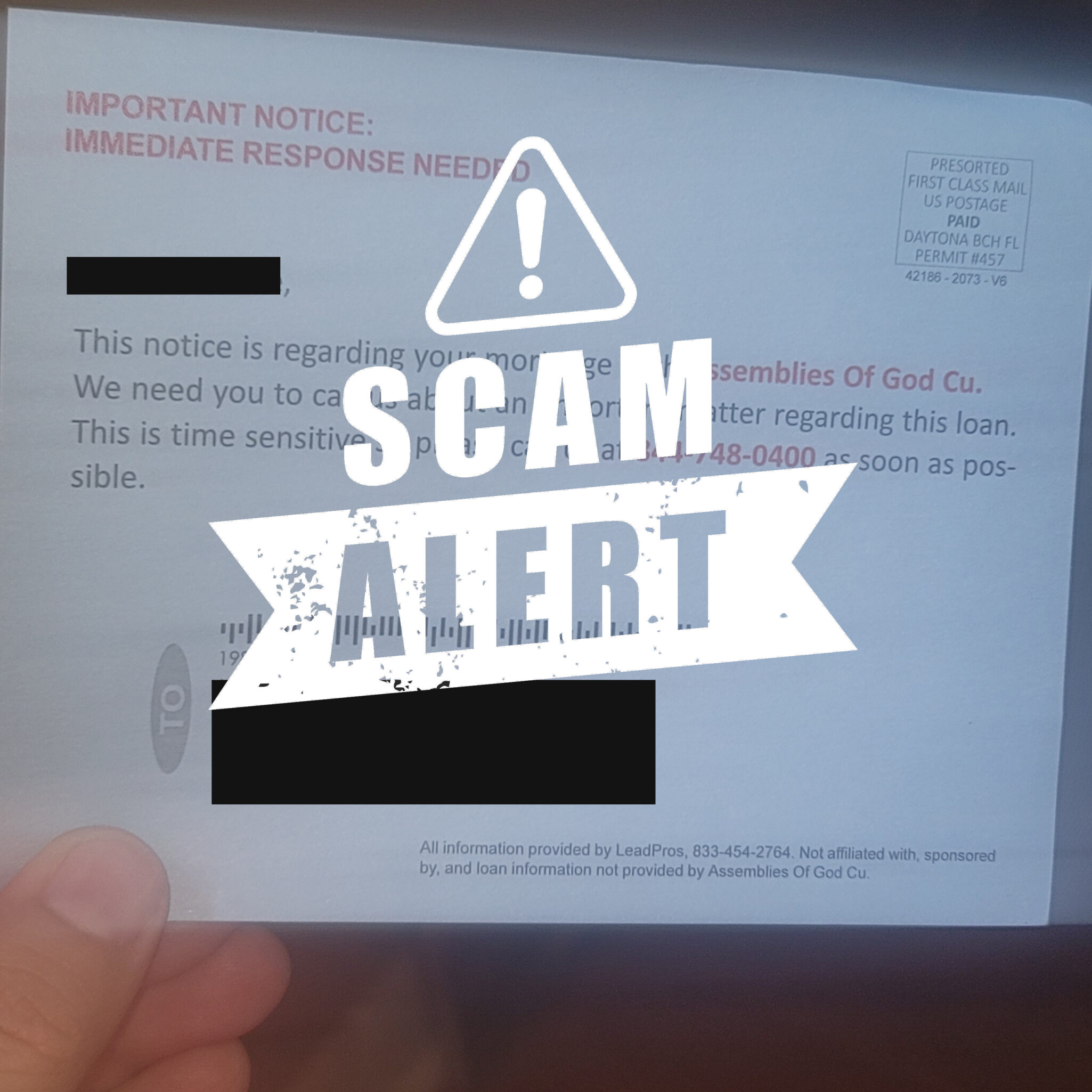

Scam Alert

Mortgage Postcard Scam Alert

If you recently closed on a mortgage and have yet to receive a postcard in the mail requesting an “immediate response” to “an important matter” regarding your loan, just wait, It’s probably coming.

This is because a long-running mortgage scam that uses publicly available information such as a mortgage closing date to target new homeowners shows no signs of abating. How do we know? We recently got a little postcard ourselves.

What are these postcards, and who is sending them?

These postcards (which come in a variety of colors) are being sent to consumers all around the country.

Please be aware that this is a scam and did not come from AGCU, or any financial institution. There is a small disclaimer in the bottom right corner indicating the sender is “not affiliated with, sponsored by, and loan information not provided by Assemblies of God Cu.” It further states that the information was provided by “LeadPros” Our research suggests this home warranty corporation is the culprit behind these postcards. The company has an “F” rating with the Better Business Bureau.

How did the postcard senders get my information?

At AGCU, we’re committed to protecting our member’s personal information. We would never send you a postcard requesting that you call us regarding your mortgage. Likewise, we do not sell or otherwise distribute it to non-affiliated third parties.

However, some information about mortgages, regardless of what lender the consumer works with, is public record. That’s how someone like this may obtain your contact information. Do note that the account number listed does not match yours; this should immediately alert you to the likelihood of this being a scam.

What if I call the number on the postcard?

We advise our members NOT to call the number listed. Calling the number may connect you with a real person, or it may connect you to automated recording prompts. Regardless, do not offer them your personal information.

What should I do if I get this postcard?

The best thing to do is disregard the postcard. Dispose of it however you would any other junk mail you receive. In addition, please contact a Member Service Representative at 417-831-4398 should you have additional questions.

If you would like to take further action, consider filing a complaint with your State’s Attorney General’s Consumer Protection Division.

Q: What happens when a mortgage lender checks my credit score?

Q: What happens when a mortgage lender checks my credit score?