Why We Urge You To Oppose A New IRS Reporting Proposal

Why We Urge You To Oppose A New IRS Reporting Proposal

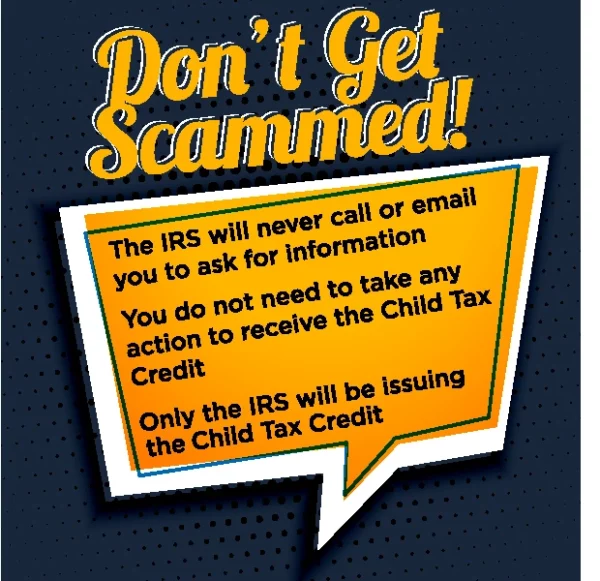

As many of you have heard, Congress has been considering a proposal that would require credit unions and other financial institutions to report to the Internal Revenue Service (IRS) how much money has gone into and out of many members’ accounts above a certain threshold.

At AGCU, we care about your privacy and are committed to informing you when legislation is being discussed that could directly affect you. We are strongly opposed to the following proposal and while this is not currently in effect, we highly encourage you to join us in sharing your voice to reject this new IRS reporting provision.

As your credit union, this unprecedented access raises several concerns:

- This proposal would violate consumers’ personal privacy by forcing credit unions and banks to provide the government with information that does not reflect taxable activity.

- The government relies on old data systems to store and secure IRS information. These systems have already been compromised in recent years, and the addition of this type of data only increases the likelihood of a future breach.

- This proposal could create an undue regulatory burden on some financial institutions.

While AGCU must abide by all federal regulations, we know your financial privacy is of utmost importance. As a member of AGCU, we encourage you to contact your US Senator and US Representative to voice your opposition today. Your voice matters!

We need to work together to stop the proposed provision that allows the IRS to access nontaxable deposit account information from credit unions and banks.

Tell your Representatives to oppose jeopardizing consumers’ personal finance privacy. Click Here To Take Action Now!

The Bottom Line:

Don’t jeopardize consumers’ personal financial privacy by allowing the IRS to access nontaxable deposit account information from credit unions and banks.

Banking With A Purpose

Much more than a catchphrase, our tagline is our passion, our reason why we do what we do. This is the impact of your membership with AGCU. Learn More About Banking with a Purpose

In order to be a part of our giveaway, each contestant puts their contact information into a survey,

In order to be a part of our giveaway, each contestant puts their contact information into a survey, On July 30, 2021, The family of Christopher Hill, Director of Computer Applications and Development at General Council of the Assemblies of God, sustained a great loss.

On July 30, 2021, The family of Christopher Hill, Director of Computer Applications and Development at General Council of the Assemblies of God, sustained a great loss.

If you’re looking to purchase an ATV, you’ll first need to choose between the two main categories for these vehicles: utility and sport. Utility ATVs have larger tires, are generally easier to ride and have fewer bells and whistles than sport ATVs. As their name implies, utility ATVs are designed for work (though they still deliver a fun ride), while sport ATVs are more commonly used for recreational purposes only. Prices for each can run from as low as just a few thousand dollars to a whopping $65,000 for a luxury, fully loaded vehicle.

If you’re looking to purchase an ATV, you’ll first need to choose between the two main categories for these vehicles: utility and sport. Utility ATVs have larger tires, are generally easier to ride and have fewer bells and whistles than sport ATVs. As their name implies, utility ATVs are designed for work (though they still deliver a fun ride), while sport ATVs are more commonly used for recreational purposes only. Prices for each can run from as low as just a few thousand dollars to a whopping $65,000 for a luxury, fully loaded vehicle. You could save up to 2% on your next auto, motorcycle, RV, or watercraft loan.* This includes NEW & USED vehicles.

You could save up to 2% on your next auto, motorcycle, RV, or watercraft loan.* This includes NEW & USED vehicles.