How to Avoid Rental Scams

You just saw an ad for the perfect housing rental. It’s located in the neighborhood you want, the monthly rent is lower than you’ve seen anywhere else and the landlord doesn’t require a credit check. It sounds too good to be true!

It may well be. According to the Federal Bureau of Investigation’s 2021 Internet Crime Report there were more than 11,500 internet crimes related to real estate/rentals.

Watch Out for Rental Property Scams: What You Need to Know

Navigating the rental market is already stressful enough—finding the right home, meeting your budget, coordinating a move. But the increasing prevalence of rental property scams adds an unfortunate layer of risk. Fraudsters are getting more sophisticated, creating fake listings, impersonating landlords, and inventing new ways to trick prospective renters out of their hard-earned money.

At AGCU, we care about your financial safety and want to help you recognize, avoid, and report these scams. Let’s take a closer look at how rental scams work and what you can do to protect yourself.

🚨 Common Rental Scams to Watch For

Fraudulent rental activity comes in several forms. Here are some of the most common schemes:

1. Bogus Listings

Scammers steal photos and descriptions from legitimate listings—or create completely fake ones—for properties that aren’t actually for rent (or don’t exist at all). These listings often feature beautiful photos, appealing amenities, and rent prices that are significantly below market. The scammer will claim to be out of town or otherwise unavailable to show the property and will pressure you to send a deposit or application fee sight unseen.

✅ AGCU Tip: If the deal seems too good to be true, it usually is.

2. Payment Redirection (Spoofing)

In this scam, fraudsters impersonate a legitimate landlord or property manager—sometimes by hacking into their email account or mimicking it with a similar address. They then convince the renter to wire or transfer the rent or deposit into a fraudulent account.

✅ AGCU Tip: Always verify payment instructions through a second source, such as a phone call or verified company website.

3. Overpayment Scam

This one targets landlords. A scammer pretending to be a tenant sends a check for more than the agreed rent and asks the landlord to refund the excess. The original payment is fake and will bounce, but the refund goes through—leaving the landlord with a financial loss.

✅ AGCU Tip: Never refund overpayments. If something feels off, hold the funds until they fully clear.

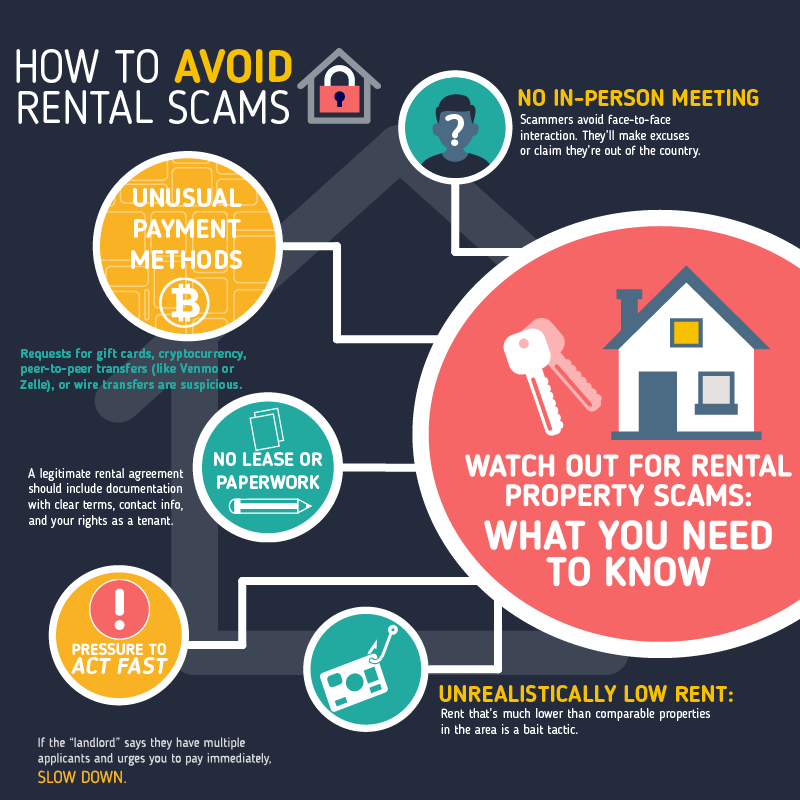

⚠️ Red Flags That Signal a Scam

Be alert to these warning signs:

- Unrealistically Low Rent: Rent that’s much lower than comparable properties in the area is a bait tactic.

- Pressure to Act Fast: If the “landlord” says they have multiple applicants and urges you to pay immediately, slow down.

- No In-Person Meeting: Scammers avoid face-to-face interaction. They’ll make excuses or claim they’re out of the country.

- Unusual Payment Methods: Requests for gift cards, cryptocurrency, peer-to-peer transfers (like Venmo or Zelle), or wire transfers are suspicious.

- No Lease or Paperwork: A legitimate rental agreement should include documentation with clear terms, contact info, and your rights as a tenant.

🛡️ How to Protect Yourself from Rental Scams

1. Verify the Listing’s Authenticity

Use a reverse image search to see if the photos have been lifted from another listing. Cross-check the property on multiple platforms to confirm consistency.

2. Tour the Property

Always request an in-person tour—or at least a live video walkthrough. Scammers often provide pre-recorded videos or stall when asked to meet.

3. Research the Landlord

Look up the landlord’s name, the company’s contact information, and whether they’re listed with the county assessor’s office as the property owner.

4. Pay Securely & Wisely

Avoid paying before signing a legitimate lease. Use traceable payment methods like checks or direct bank transfers to verified accounts. Never send money via gift cards or cryptocurrency.

5. Get Everything in Writing

From rent terms to deposit details, ensure every conversation is followed up with documentation. If they avoid putting things in writing, that’s a red flag.

🆘 If You’ve Been Targeted or Scammed

If you believe you’re a victim of a rental scam:

- Contact AGCU Immediately

We may be able to help recover or stop a transaction if it hasn’t been processed yet. - File a Police Report

Notify your local law enforcement agency and provide all details and communications. - Report to the Authorities

- Federal Trade Commission (FTC) at reportfraud.ftc.gov

- Internet Crime Complaint Center (IC3) at ic3.gov

- Listing Platforms (Craigslist, Zillow, Facebook Marketplace, etc.) to remove the fraudulent posting.

- Monitor Your Accounts

If you shared sensitive personal or financial info, consider monitoring your credit or placing a fraud alert on your accounts.

💬 Stay Vigilant. Stay Informed. Stay Safe.

At AGCU, we don’t just help you manage your money—we help you protect it. If something seems suspicious or too good to be true, we’re just a call, message, or video chat away. Reach out before making a payment you’re unsure about. It’s always better to double-check than to risk your finances.

🔗 Need help?

📞 Call us at 866-508-AGCU (Monday–Friday, 7:30 a.m.–5:00 p.m. CT)

📧 Email us at info@agcu.org

📹 Or use secure Video Banking

Fraudsters are creative—but awareness is your strongest defense. Let’s continue to build a safe, smart, and fraud-free financial future together.Avoiding

If you’re ready to ditch renting and invest in a home of your own, AGCU is here to help. Our Mortgage Team understands the journey to homeownership and is ready to walk you through every step. From pre-approval to closing, we’ll help you find a loan that fits your life—and your dreams. Contact us today and let’s make home happen.