6 Habits That Cost You $50 A Month or More

How much are your habits hurting your wallet?

You don’t need to have a pile of gold or a million dollars’ worth of jewelry to need a safe deposit box. Learn why you need one, what to put it in and how to handle the legal side!

Wire transfer scams can involve unexpected requests for money through email, phone call, or message. Scammers may pressure you to send money because it’s easy for them to take your money and disappear. Once the money is gone, it’s unlikely you’ll be able to get it back. Learn how to identify and protect yourself from these scammers

If you just got overpaid for an item you’re selling online, you may be caught in an overpayment scam.

At AGCU, we’re excited to introduce Finicity’s seamless integration with our digital banking platform, bringing you a revolutionary way to manage your finances. With Finicity, you can easily transfer money between your accounts at different financial institutions and get a real-time view of your financial health—all from the convenience of the AGCU dashboard.

Our money moves mostly via ACH and wire transfers, but there are some major differences between them, especially when it comes to speed and security. We’ve got it all explained!

With so many financial products available, choosing which type of account to open can be just as stressful as deciding where to open one. For consumers looking for earnings on their savings, one of the options that AGCU offers is share certificates. Here’s a brief overview of how they work and some of their advantages and disadvantages.

Jump To:

A certificate of deposit (CD) is a low-risk savings tool that can boost the amount you earn in interest while keeping your money invested in a relatively safe way.

Like savings accounts, CDs are considered low risk because they are FDIC-insured up to $250,000. However, CDs generally allow your savings to grow at a faster rate than they would in a savings account.

In exchange for depositing your money into a bank for a fixed period (usually called the term or duration), the bank pays a fixed interest rate that’s typically higher than the rates offered on savings accounts. When the term is up (or when the CD matures), you get back the money you deposited (the principal) plus any interest that has accrued.

If you need to access your funds before the CD’s term ends, you are subject to an early withdrawal penalty, which can significantly reduce the interest you earned on the CD.

Tip: Before opening a CD, make sure you have an emergency fund—a comfortable amount of savings in an easily accessible account, such as a savings account.

CDs come in varying terms and may require different minimum balances. The rate you earn typically varies by the term and how much money is in the account. In general, the longer the term and the more money you deposit, the higher the rate you are offered. (A longer term does not necessarily require a larger minimum balance.)

Like savings accounts, CDs earn compound interest—meaning that periodically, the interest you earn is added to your principal. Then that new total amount earns interest of its own, and so on.

Because of the compound interest, it is important to understand the difference between interest rate and annual percentage yield (APY). The interest rate represents the fixed interest rate you receive, while APY refers to the amount you earn in one year, taking compound interest into account.

There are a number of factors to consider when choosing a CD. First, when do you need the money? If you need it soon, consider a CD with a shorter term. But if you’re saving for something five years down the line, a CD with a longer term and higher rate may be more beneficial. Check CD Rates Here

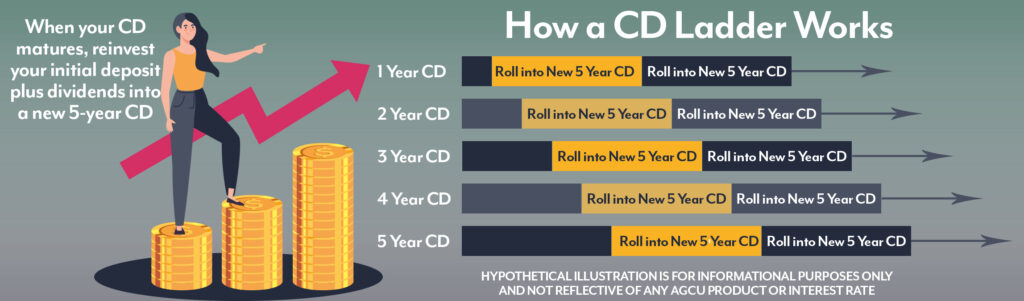

Also, consider the economic environment. If it seems that interest rates may rise, or if you want to open multiple CDs, CD laddering can be a good option.

Overall interest rates may change during your CD’s term. If rates rise, you miss out on earning those higher rates, since your money is committed for the CD’s term. However, if rates go down, you benefit: You still earn the higher rate that was offered when you opened the CD. CD laddering, buying multiple CDs of varying term lengths, can help address this concern.

It can also be a way for you to take advantage of longer terms (and therefore higher interest rates) while still giving you access to some of your money each year.

With a CD ladder, you divide your initial investment into equal parts and invest each portion in a CD that matures every year. For example, say Leo has $10,000. To build a CD ladder, he invests $2,000 each in a 1-year, 2-year, 3-year, 4-year and 5-year CD. As each CD matures, he reinvests the money at the current interest rate or uses the cash for another purpose. If Leo reinvests his money, he might choose a new 5-year CD, which would ensure he has one CD maturing each year as long as he continues laddering.

Be sure to consider other options for saving or investing your funds. Diverse accounts offer different levels of risk and return. Learn about AGCU CD Rates and get started today!

Time to Read: 3 minutes

Time to Read: 3 minutes

Having a good credit score can open doors to so many financial opportunities, like lower interest rates on auto loans, the chance to buy a house, and more credit opportunities. And while boosting your credit score may seem like a tough task, it’s doable if you know how to go about it. Here are some simple steps that can help you improve your credit score in no time!

Knowing the state of your credit score begins with checking your credit report, which is a record of your credit history that contains details about your credit accounts, payment history, and debts. You can get a free credit report from each of the three main credit bureaus (Equifax, Experian, and TransUnion) once a year. Give your report a careful look and dispute any errors you find with the credit bureau.

Your payment history is a big factor that impacts your credit score, so don’t be late or miss payments. According to Wells Fargo, payment history makes up 35% of your FICO credit score – that’s a big deal! So, it’s definitely a good idea to set up auto payments for your bills and work on paying off past debts to avoid future late payments.

Your credit utilization, or the amount of credit you use compared to your credit limit, is another key factor that affects your credit score. Keep your utilization low (under 30% according to Experian) by paying off your credit card balances in full each month and only using your card when you need to. If you have high credit card balances, consider consolidating with a personal loan or balance transfer credit card.

The longer your credit history, the better your credit score, so try to keep old credit accounts open and in good standing. According to CreditKarma, the age of your credit history generally accounts for 15% of your total credit scores. A good rule-of-thumb is to think twice before closing an old account, no matter what it is, because it could hurt your credit score if you’re not careful.

For example, many young adults these days begin their credit history when they take out student loans in their late teens/early 20s. If you are planning on paying off your student loans in a shorter period of time (less than 5 years), you may want to consider getting another line of credit going so that you don’t see your credit score drop suddenly (according to Transunion) once you pay off your longest credit history item.

Every time you apply for new credit, like a personal loan or a vehicle loan, it shows up as a hard inquiry on your credit report, which can lower your credit score. While new credit apps only account for 10% of your FICO credit score, according to Bankrate, apply for credit when you need it and avoid opening too many new accounts in a short period of time.

If your credit score isn’t looking so good, a secured credit card can help big time. This type of card requires a cash deposit, which becomes your actual credit limit. Use the card responsibly by making on-time payments like you would with a regular credit card.

Make sure to follow standard principles, like keeping your utilization low, and over time you can build a good credit history and improve your score. This option definitely poses the least amount of risk to those who have poor spending habits!

If you’re struggling with debt and your credit score is suffering, a credit counselor can help. They can help you create a budget, reduce debt, and improve your credit score. There are many reputable credit counseling agencies that offer free or low-cost services, so do your research and find one that works for you.

According to the Consumer Financial Protection Bureau, your debt-to-income ratio, or the amount of debt you have compared to your income, is another factor that affects your credit score.

Keep your ratio low (According to Experian, many lenders prefer ratios below 36%) by reducing debt and increasing income, and consider consolidating your debt with a personal loan or balance transfer credit card.

Great credit scores can open up a world of financial opportunities, from lower interest rates on loans to buying a house. But don’t worry, boosting your credit score is easier than it seems!

Start by checking your credit report and disputing any errors. Making timely payments, reducing credit utilization, keeping old accounts open, limiting new credit apps, and getting a secured credit card can also help move the needle in the right direction.

If you’re struggling with debt, seek help from a credit counselor or keep a healthy debt-to-income ratio. So, take control of your finances and show your credit score who’s boss!

Are you regularly tracking your spending? Knowing where your money is going will help you make more responsible spending decisions in the future.

Budgets need to be reviewed and tweaked every few months or so to ensure they still work for present life circumstances. If your budget no longer works for you, tweak until it does.

Have you made as much progress in your debt-paying journey as you’d hoped to by this point? Can you beef up any payments to make debt disappear sooner?

Have you had the big money talk with your partner? Need to revisit any of the topics you’ve discussed, such as sharing accounts, dividing expenses and saving up for a shared dream?

Review some of your recent purchases. Are you blowing money on stuff you don’t need instead of relieving stress in a healthier manner? If so, look for better ways to de-stress.

Are you remembering to pay it forward? The money, time and smiles we share are the only moments that are truly ours.

Are you remembering to feed your savings? At this time, you may want to consider increasing the amount you’re regularly putting into savings by trimming some discretionary expenses.

Are you remembering to work your just-for-fun expenses into your budget so you can indulge without guilt? Now is a good time to look back at your indulgences to figure out if they were really good uses for your money.

If you’ve been following the rules for boosting and maintaining a high credit score, like paying your bills on time, having several active cards, and keeping your credit utilization low, your score should have improved during these last few months.

Review your retirement accounts and assess whether your funds have reached the place you’d hoped they would by now.

Make sure your investments are performing well and that your assets are optimally diversified.

In this final step, you’ll review your financial health on a regular basis, just as you’ve done here.

Reviewing your financial health on a regular basis is an important part of staying financially fit.

Much more than a catchphrase, our tagline is our passion, our reason why we do what we do. This is the impact of your membership with AGCU.

Learn More About Banking with a Purpose

The world of investing can be confusing, especially for a first-timer. No worries, though; AGCU can help! Here’s how to start investing in five easy steps.

If you’re investing, be prepared for potential losses, because there are no sure things. But how much loss can you take? Your risk tolerance will vary according to the time horizon you’re working with, the amount of money you can afford to lose and your objectives.

Why are you investing this money? Do you hope to save enough money for a down payment, or to fund your retirement? Or, are you simply looking for a way to grow your money? Identifying your investment goals will help you choose your investment vehicles and the amount of money you’re comfortable investing.

Next, you’ll need to find an investing style that suits your personality and investing goals. Here are your basic choices:

You’re ready to choose your investments! Here are some popular first-time investments:

Monitor and adjust your portfolio on a regular basis to keep it diversified and help minimize the risk of loss. Follow these steps to help you get started investing with more confidence.

If you’re ready to start investing or would like some more advice, Reach out to our good friends at AGFinancial

Read Step 1: How to Track Your Spending

Read Step 2: Creating a Budget

Read Step 4: Have the Money Talk With Your Partner

Read Step 5: Practice Mindful Spending

Read Step 7: How to Pay Yourself First

Read Step 8: Know When and How to Indulge

Read Step 9: Build and Maintain an Excellent Credit Score

Read Step 10: Plan for Retirement

Read Step 12: Review and Tweak

Much more than a catchphrase, our tagline is our passion, our reason why we do what we do. This is the impact of your membership with AGCU.

Learn More About Banking with a Purpose