How to Avoid Rental Scams

You just saw an ad for the perfect housing rental. It’s located in the neighborhood you want, the monthly rent is lower than you’ve seen anywhere else and the landlord doesn’t require a credit check. It sounds too good to be true!

It may well be. According to the Federal Bureau of Investigation’s 2021 Internet Crime Report there were more than 11,500 internet crimes related to real estate/rentals.

Watch Out for Rental Property Scams: What You Need to Know

Navigating the rental market is already stressful enough—finding the right home, meeting your budget, coordinating a move. But the increasing prevalence of rental property scams adds an unfortunate layer of risk. Fraudsters are getting more sophisticated, creating fake listings, impersonating landlords, and inventing new ways to trick prospective renters out of their hard-earned money.

At AGCU, we care about your financial safety and want to help you recognize, avoid, and report these scams. Let’s take a closer look at how rental scams work and what you can do to protect yourself.

🚨 Common Rental Scams to Watch For

Fraudulent rental activity comes in several forms. Here are some of the most common schemes:

1. Bogus Listings

Scammers steal photos and descriptions from legitimate listings—or create completely fake ones—for properties that aren’t actually for rent (or don’t exist at all). These listings often feature beautiful photos, appealing amenities, and rent prices that are significantly below market. The scammer will claim to be out of town or otherwise unavailable to show the property and will pressure you to send a deposit or application fee sight unseen.

✅ AGCU Tip: If the deal seems too good to be true, it usually is.

2. Payment Redirection (Spoofing)

In this scam, fraudsters impersonate a legitimate landlord or property manager—sometimes by hacking into their email account or mimicking it with a similar address. They then convince the renter to wire or transfer the rent or deposit into a fraudulent account.

✅ AGCU Tip: Always verify payment instructions through a second source, such as a phone call or verified company website.

3. Overpayment Scam

This one targets landlords. A scammer pretending to be a tenant sends a check for more than the agreed rent and asks the landlord to refund the excess. The original payment is fake and will bounce, but the refund goes through—leaving the landlord with a financial loss.

✅ AGCU Tip: Never refund overpayments. If something feels off, hold the funds until they fully clear.

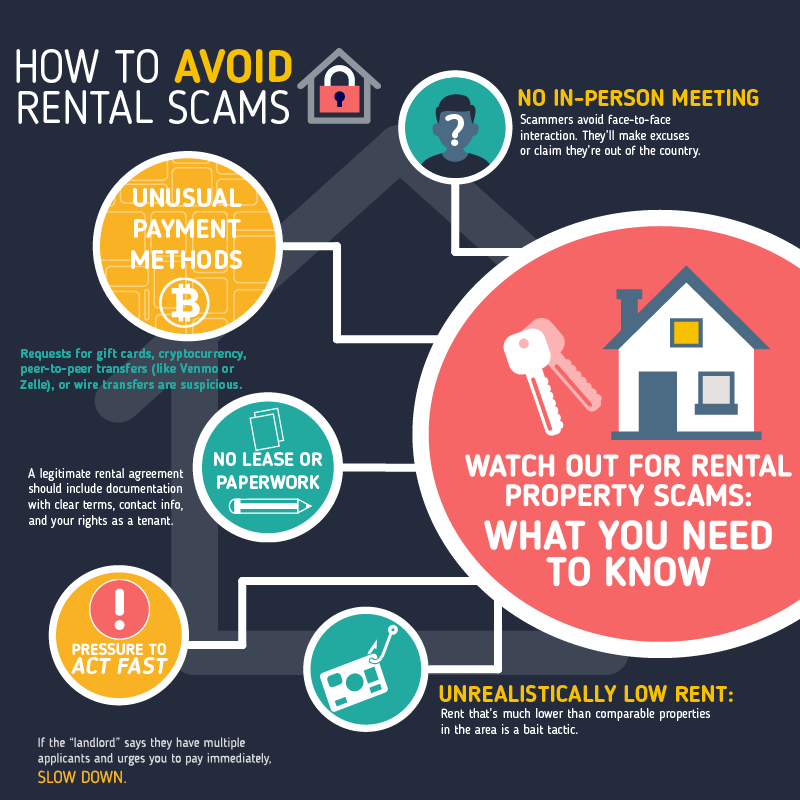

⚠️ Red Flags That Signal a Scam

Be alert to these warning signs:

- Unrealistically Low Rent: Rent that’s much lower than comparable properties in the area is a bait tactic.

- Pressure to Act Fast: If the “landlord” says they have multiple applicants and urges you to pay immediately, slow down.

- No In-Person Meeting: Scammers avoid face-to-face interaction. They’ll make excuses or claim they’re out of the country.

- Unusual Payment Methods: Requests for gift cards, cryptocurrency, peer-to-peer transfers (like Venmo or Zelle), or wire transfers are suspicious.

- No Lease or Paperwork: A legitimate rental agreement should include documentation with clear terms, contact info, and your rights as a tenant.

🛡️ How to Protect Yourself from Rental Scams

1. Verify the Listing’s Authenticity

Use a reverse image search to see if the photos have been lifted from another listing. Cross-check the property on multiple platforms to confirm consistency.

2. Tour the Property

Always request an in-person tour—or at least a live video walkthrough. Scammers often provide pre-recorded videos or stall when asked to meet.

3. Research the Landlord

Look up the landlord’s name, the company’s contact information, and whether they’re listed with the county assessor’s office as the property owner.

4. Pay Securely & Wisely

Avoid paying before signing a legitimate lease. Use traceable payment methods like checks or direct bank transfers to verified accounts. Never send money via gift cards or cryptocurrency.

5. Get Everything in Writing

From rent terms to deposit details, ensure every conversation is followed up with documentation. If they avoid putting things in writing, that’s a red flag.

🆘 If You’ve Been Targeted or Scammed

If you believe you’re a victim of a rental scam:

- Contact AGCU Immediately

We may be able to help recover or stop a transaction if it hasn’t been processed yet. - File a Police Report

Notify your local law enforcement agency and provide all details and communications. - Report to the Authorities

- Federal Trade Commission (FTC) at reportfraud.ftc.gov

- Internet Crime Complaint Center (IC3) at ic3.gov

- Listing Platforms (Craigslist, Zillow, Facebook Marketplace, etc.) to remove the fraudulent posting.

- Monitor Your Accounts

If you shared sensitive personal or financial info, consider monitoring your credit or placing a fraud alert on your accounts.

💬 Stay Vigilant. Stay Informed. Stay Safe.

At AGCU, we don’t just help you manage your money—we help you protect it. If something seems suspicious or too good to be true, we’re just a call, message, or video chat away. Reach out before making a payment you’re unsure about. It’s always better to double-check than to risk your finances.

🔗 Need help?

📞 Call us at 866-508-AGCU (Monday–Friday, 7:30 a.m.–5:00 p.m. CT)

📧 Email us at info@agcu.org

📹 Or use secure Video Banking

Fraudsters are creative—but awareness is your strongest defense. Let’s continue to build a safe, smart, and fraud-free financial future together.Avoiding

If you’re ready to ditch renting and invest in a home of your own, AGCU is here to help. Our Mortgage Team understands the journey to homeownership and is ready to walk you through every step. From pre-approval to closing, we’ll help you find a loan that fits your life—and your dreams. Contact us today and let’s make home happen.

What is a HELOC?

Home Equity Loan vs. HELOC: What’s the Difference?

One of the biggest perks of homeownership is the ability to build equity over time. You can use that equity to secure low-cost funds in the form of a second mortgage—either a one-time loan or a home equity line of credit (HELOC).

Home equity loans and HELOCs use the equity in your home—that is, the difference between your home’s value and your mortgage balance—as collateral. As the loans are secured against the equity value of your home, home equity loans offer extremely competitive interest rates—usually close to those of first mortgages. Compared with unsecured borrowing sources, such as credit cards, you’ll be paying less in financing fees for the same loan amount.

Home Equity Loans

A home equity loan, or second mortgage, comes as a lump sum of cash. It’s an option if you need the money for a one-time expense, such as a wedding or a kitchen renovation. These loans usually offer fixed rates, so you know precisely what your monthly payments will be when you take one out. Learn about Second Mortgages here.

We offer a fixed rate option on our second mortgages with a maximum term of fifteen (15) years.

Several advantages of working with us on your loan:

- Low closing cost

- No pre-payment penalty

- Retained servicing (excludes 30 year fixed)

- Variety of payment options

- Cash-out refinances on specific mortgage plans

A HELOC Is…

A HELOC is a line of credit that revolves – similar to a credit card – and can be used for large expenses, unexpected expenses, home remodeling, debt consolidation(1) or the like. Like a credit card, each time you repay some or all of the money used from the HELOC, your credit line is correspondingly replenished.

A HELOC is a secured loan in that you are borrowing against the equity that has been built in your house. Typically, lenders will let you borrow from 80 to 95 percent of your home’s equity.

When you obtain a HELOC, you are given a draw period, or length of time during which your line of credit will stay open. Draw times typically average 10 years. After the draw period is over, you enter into the repayment period, which for qualified members, we offer a great rate with a maximum term of fifteen (15) years.

AGCU offers HELOC’s in the following Missouri counties: Greene, Dade, Polk, Dallas, Webster, Christian, Stone, Lawrence, and Taney.

A HELOC Works by…

Borrowers can apply for HELOCs through AGCU’s Home Loan Center. The lender will assess the borrower’s home LTV (loan-to-value) ratio, as well as their income, credit score and other debt. Like a home loan, HELOCs – once approved – include closing costs. A Mortgage and HELOC document checklist is available here.

HELOCs typically have a variable rate which, in large part, will be based on the current prime rate. This means that when rates rise – as they have been lately – the rate on a HELOC will rise accordingly. Even so, the rate on a HELOC is usually lower than credit card rates.

Once the HELOC has been approved, the borrower begins the draw period. During this time, any money borrowed from the line of credit is repaid each month by interest-only payments, which may mean a lower monthly payment. When the draw period is over, the borrower moves to the repayment period, during which time the monthly payment begins to include principal plus interest for any money borrowed, meaning the monthly payment may increase.

The Phases of HELOCs

Most home equity credit lines have two phases. First, a draw period, often 10 years, during which you can access your available credit as you choose. Typically, HELOC contracts only require small, interest-only payments during the draw period, though you may have the option to pay extra and have it go toward the principal.

After the draw period ends, you can sometimes ask for an extension. Otherwise, the loan enters the repayment phase. From here on out, you can no longer access additional funds, and you make regular principal-plus-interest payments until the balance disappears. Most lenders have a 20-year repayment period after a 10-year draw period. During the repayment period, you must repay all the money you’ve borrowed, plus interest at a contracted rate. Some lenders may offer borrowers different types of repayment options for the repayment period.

AGCU Home Loan Center

Every borrower is different, and we offer a variety of products to meet your requirements. We make the mortgage process simple and straightforward by offering the latest in financial tools that enable you to make sound financial choices. Whatever your real estate lending needs are, AGCU is here to help you navigate the process. Call our team of mortgage professionals at 866-508-2428(AGCU) or email us for more information.

KEY TAKEAWAYS

- Home equity can be a great source of value for homeowners to access cash for renovations, large purchases, or alternative debt repayment.

- Home equity loans and lines of credit are secured against the value of your home equity, so lenders may be willing to offer rates that are lower than they do for most other types of personal loans.

- A home equity loan comes as a lump sum of cash, often with a fixed interest rate.

- A home equity line of credit is a revolving source of funds, much like a credit card, that you can access as you choose.

- Learn more about Home Equity Loans or Lines of Credit

Banking With A Purpose

Much more than a catchphrase, our tagline is our passion, our reason why we do what we do. This is the impact of your membership with AGCU.

Learn More About Banking with a Purpose

5 Reasons to Get Preapproved for a Mortgage

If you’re thinking about buying a home, getting preapproved for a mortgage might not sound like the most exciting part of the journey—but it’s one of the smartest moves you can make. Whether you’re a first-time buyer or a seasoned homeowner, a mortgage preapproval gives you clarity, confidence, and a competitive edge in today’s housing market. Visit our Home Loan Center to Apply Now!

Here are five compelling reasons why getting preapproved should be your first step:

1. Know Exactly What You Can Afford

A preapproval helps you determine how much house you can comfortably afford based on your income, credit, and financial situation. Instead of guessing or relying on online calculators, you’ll get a realistic price range to focus your search and avoid falling in love with a home that’s out of reach.

2. Boost Your Bargaining Power

In a competitive market, preapproval gives you a serious advantage. Sellers and real estate agents are far more likely to consider an offer from a buyer who already has financing lined up. It shows you’re prepared, committed, and financially capable—which can make your offer stand out in a sea of hopeful buyers.

3. Speed Up the Homebuying Process

When you’re preapproved, much of the paperwork is already taken care of. That means once your offer is accepted, you can move faster through the mortgage process. In a hot market, every day counts—and preapproval can save you valuable time.

4. Avoid Surprises Later

A preapproval includes a full review of your credit report, income, and financial situation. That means you’ll uncover any potential red flags early—before they can slow down your loan approval or derail your homebuying plans. It’s a proactive way to prevent unexpected bumps in the road.

5. Shop with Confidence

Knowing your preapproved amount brings peace of mind. You can house-hunt with purpose, avoid unnecessary stress, and make decisions with confidence. Plus, it’s an empowering step that shows you’re ready to move forward when you find the right home.

Getting preapproved for a mortgage isn’t just a smart financial step, it’s a powerful move that sets you up for success in today’s competitive housing market. From knowing your budget to gaining an edge with sellers, preapproval empowers you to shop with confidence and act quickly when you find the right home.

Ready to Get Started?

At AGCU, we make the preapproval process simple, secure, and stress-free. Our mortgage team is here to walk you through every step. Click Here to start your preapproval today and take the first step toward finding your dream home:

Download our FREE Mortgage Checklist

Getting preapproved for a mortgage isn’t just a smart financial step, it’s a powerful move that sets you up for success in today’s competitive housing market. From knowing your budget to gaining an edge with sellers, preapproval empowers you to shop with confidence and act quickly when you find the right home.

Banking With A Purpose

Much more than a catchphrase, our tagline is our passion, our reason why we do what we do. This is the impact of your membership with AGCU. Learn More About Banking with a Purpose

Frequently Asked Questions About Mortgage Pre-approval

How far in advance should I get preapproved for a mortgage?

It’s best to get preapproved for a mortgage at least 1–3 months before you start house hunting. This gives you time to understand your budget, correct any issues on your credit report, and position yourself as a serious buyer when making an offer.

What is the minimum credit score to buy a house in Missouri?

Most lenders in Missouri look for a minimum credit score of 620 for conventional loans. However, government-backed loans like FHA may allow lower scores. AGCU works with members to find the right mortgage option based on their unique financial situation.

Does getting preapproved hurt your credit?

A mortgage preapproval typically involves a hard inquiry on your credit report, which may cause a small, temporary dip in your credit score. However, this impact is usually minimal and well worth the benefits of being preapproved when house hunting.

Will I lose my deposit if I am denied a mortgage?

You could lose your earnest money deposit if you’re denied a mortgage; especially if your purchase contract doesn’t include a financing contingency, which protects you in case your loan falls through. Without this safeguard, a denied loan could mean walking away from a home and your deposit.

That’s why getting preapproved before making an offer is so important. A mortgage preapproval gives you a clearer picture of what you can afford and shows sellers you’re a serious, qualified buyer. It also reduces the risk of loan denial after your offer is accepted. At AGCU, our preapproval process helps set you up for a smoother, more secure homebuying experience from day one.

AGCU Names Peter Shiner as New President & CEO

Springfield, Mo – April 7, 2025– The Assemblies of God Credit Union (AGCU) is pleased to announce the appointment of Peter Shiner as its new President and Chief Executive Officer. With over 15 years of leadership experience in federally insured credit unions and community banks, Shiner brings a strong background in strategic financial management, regulatory compliance, and capital markets expertise.

Shiner joined AGCU as Senior Vice President and Chief Risk Officer. His leadership has played a crucial role in strengthening AGCU’s positioning for long-term growth.

“I am honored to serve as AGCU’s next President and CEO,” said Shiner. “and I look forward to building a high-performing team that understands the power of relationships and values our members’ trust. Together, we will continue to expand our services, embrace new opportunities, and remain a faith-driven financial partner for our members.”

Peter and his wife, Whitney, along with their three young children, are excited to make Springfield their home. They look forward to becoming part of the community and embracing AGCU’s mission of serving members with integrity and care.

Prior to AGCU, Shiner held leadership positions at Performance Trust Capital Partners, First Entertainment Credit Union, and Academy Securities, where he advised executive teams and boards on risk management, investment strategies, and institutional growth. He has overseen multi-billion-dollar loan and fixed-income portfolios, executed over $6.5 billion in asset allocation strategies, and played a pivotal role in enhancing financial institutions’ balance sheet flexibility and growth.

“We are excited to welcome Peter Shiner as our new President and CEO,” said Bill Perkin, treasurer of the AGCU board of directors. “His strategic vision, deep financial expertise, and commitment to faith-based financial services make him the ideal leader to guide AGCU into the future. We look forward to his leadership as we continue to grow and serve our members with excellence.”

Shiner holds an MBA from Azusa Pacific University and a BA from Wheaton College. A former NCAA baseball athlete and Eagle Scout, he brings a disciplined, results-driven approach to leadership.

As CEO, Shiner will focus on expanding AGCU’s financial services, strengthening member engagement, and ensuring the credit union remains a trusted partner for churches, ministries, and individuals seeking financial solutions aligned with their values.

For more information, visit www.agcu.org.

What is Banking With a Purpose?

Banking with a Purpose at AGCU goes beyond traditional financial services. It is about connecting your faith, family, and finances. Our mission is to improve the lives of our members by providing financial solutions for individuals, ministries, and businesses related to the Assemblies of God fellowship.

Our commitment includes giving back to the community. Each year, we tithe 10% of our annual earnings to support various initiatives, ranging from church planting, ministries and humanitarian projects to educational advancements and scholarships. Join us at AGCU and see how Banking with a Purpose can make a difference in your life and community.

Honoring Bruce Webb’s Leadership & Legacy at AGCU

After a decade of dedicated leadership, Bruce Webb is retiring as President & CEO of Assemblies of God Credit Union (AGCU) in Springfield, MO, Friday, April 4, 2025. His impact on our credit union and its mission has been profound.

Bruce joined AGCU in 2015, bringing 30 years of banking experience from Michigan and Minnesota, along with 40 years of involvement in the Assemblies of God fellowship. Upon arriving, he redefined AGCU’s vision: “To be the most relevant faith-based credit union in the world.” Over the past ten years, AGCU has lived out this vision, serving more than 18,000 members—including over 2,300 missionaries in 190 countries—while remaining deeply connected to the Assemblies of God fellowship.

“Bruce Webb’s leadership over the past decade has transformed AGCU, driving growth, innovation, and a stronger commitment to faith-based financial stewardship,” said Bill Perkin, treasurer, AGCU board of directors. “His vision and dedication have modernized our services and expanded our impact, leaving a lasting legacy. We are deeply grateful for his leadership and the foundation he has built for AGCU’s future.”

Under Bruce’s leadership, AGCU has reached remarkable milestones:

Growth & Expansion

- Tripled in size, becoming the largest credit union in the greater Springfield, MO area

- Ranked among the Top Five largest faith-based credit unions in the country

- Named Missouri’s fastest-growing credit union in 2022 and ranked in the Top 1% of fastest-growing credit unions nationwide

- Expanded membership eligibility from five states to all 50 states for Assemblies of God church adherents

- Achieved an average 6% annual membership growth

Financial Strength

- Recognized as one of the Top 100 Best Performing U.S. Credit Unions of 2022 by S&P Global Market Intelligence

- Increased total deposits by 155% and loan balances by 245%

- Grew revenue by 223%, capital by 125%, and net income by 373%

Community Impact & Mission Advancement

- Donated over $2.5 million to education, ministry, and humanitarian causes

- Became the second-largest PPP loan originator among Missouri credit unions (2020-2021)

- Mortgage lending team ranked among the Top 10 in Springfield, MO

- Expanded commercial, business, and church lending from $10 million to over $110 million

Innovation & Modernization

- Introduced Video Banking, allowing members to connect via mobile, computer, or in-branch

- Completed a full rebrand, including a new logo, bold new colors, and a refreshed tagline to reflect our mission and to strengthen our brand

- Renovated all AGCU buildings, enhancing both exterior and interior spaces

- Completed a banking software upgrade that added convenience and security for mobile and online users

Bruce’s vision and leadership have left an enduring legacy, ensuring a strong foundation for AGCU’s future. While he and his wife, Kimberley, will remain in Springfield, they look forward to spending more time with family—especially their four grandsons in southern Michigan.

Please join us in thanking Bruce for his years of service and leadership. We are deeply grateful for his impact on AGCU and the communities we serve.

With gratitude,

The AGCU Family

Budgeting Basics: Take Control of Your Money (and Your Future)

Budgeting doesn’t have to be overwhelming. Whether you’re just starting college, entering the workforce, or navigating life on your own, learning how to manage your money is key to financial success. In this guide, we’ll walk you through budgeting basics, practical money tips for young adults, and how AGCU’s financial tools—like high-yield checking, savings accounts, and digital banking—can help you stay on track.

7 Tips For Avoiding Common Money Mistakes – And Fixing Them With AGCU

Managing your money doesn’t come with an instruction manual — and even the most financially responsible people make a few missteps. The good news? Most common money mistakes are easy to fix with a little awareness, a solid plan, and the right financial tools.

Here are some of the most common pitfalls — and how to avoid them using AGCU’s services to build a stronger financial future

1. Ignoring Your Financial Situation

The Problem:

It’s easy to coast through daily life without knowing how much money is in your account, how much debt you owe, or even what your credit score is. But ignoring your finances can lead to overdrafts, missed payments, and a lack of savings when you need it most.

The Fix:

Take time to regularly check your balances, track spending, and monitor your progress toward financial goals. Budgeting apps, online banking tools, and simple spreadsheets can help you stay organized.

AGCU Solution:

Use Online & Mobile Banking to track your accounts anytime, anywhere. And make your money work harder with a FREE Loyalty Plus High Yield Checking Account — you’ll earn competitive interest just by managing your money well.

2. Not Having Clear Financial Goals

The Problem:

Without goals, it’s easy to spend impulsively and wonder where your money went. A lack of direction can lead to missed opportunities and little progress toward long-term dreams.

The Fix:

Set short-term and long-term goals — like building an emergency fund, saving for a home, or preparing for retirement. Goals help you focus your spending and stay motivated.

AGCU Solution:

Open a Savings Account to get started, or Money Market Account for higher returns and easy access to your funds. Planning for retirement? Consider an IRA to help your savings grow tax-advantaged over time.

3. Failing to Communicate About Money

The Problem:

Many couples or families avoid talking about money to prevent conflict — but this often leads to confusion, mismatched priorities, and financial stress.

The Fix:

Set time aside for open, honest money conversations. Align on spending habits, savings goals, and shared responsibilities to build trust and teamwork.

AGCU Solution:

Use Shared Accounts to make managing household finances easier, and explore tools like online bill pay and alerts to stay in sync and avoid surprises. All of these are included for FREE with AGCU Online and Mobile Banking

4. Not Planning for Medical Expenses

The Problem:

Medical costs can pop up unexpectedly, and without a plan in place, they can derail your budget or lead to debt.

The Fix:

Start saving ahead for future health-related needs. A dedicated account helps ensure you’re financially prepared for out-of-pocket expenses.

AGCU Solution:

Open a Health Savings Account (HSA) to save pre-tax dollars for qualified medical expenses. Funds roll over year to year, and you stay in control of how and when they’re used.

5. Letting Savings Sit Idle

The Problem:

Many people leave money in basic accounts that don’t earn much interest — which means you’re missing out on potential growth.

The Fix:

Reevaluate where you’re storing your savings. Even small improvements in your interest rate can add up over time.

AGCU Solution:

Upgrade your savings strategy with a FREE Loyalty Plus High Yield Checking Account or Money Market Account. These options offer higher returns while keeping your money accessible. or, If you won’t need immediate access to funds, consider a CD for more competitive rates

6. Not Building an Emergency Fund

The Problem:

Life is unpredictable — and without an emergency fund, even a small surprise expense can throw off your finances or push you into debt.

The Fix:

Aim to save at least a few months’ worth of expenses. Set up automatic transfers to make saving consistent and painless.

AGCU Solution:

Start with an AGCU Savings Account, and set up recurring transfers from your checking account to grow your cushion over time.

7. Relying Too Much on Credit

The Problem:

It’s easy to fall into the habit of swiping now and worrying later. High-interest credit card debt can build quickly and make it harder to save.

The Fix:

Use credit responsibly, and focus on paying down high-interest balances first. Be mindful of your credit utilization to protect your credit score.

AGCU Solution:

AGCU offers low-rate credit cards and personal loans to help you manage or consolidate debt. Use these tools to regain control and reduce interest costs.

Start Smart, Stay Strong

Avoiding these common money mistakes can help you build financial stability and confidence. Whether you’re just starting your savings journey or optimizing your current strategy, AGCU offers tools to help you succeed every step of the way — from checking and savings accounts, to IRAs, Health Savings Accounts, credit cards, and more.

💡 Ready to take control of your financial future? Learn more about Banking with a Purpose and open an account today.

Banking With A Purpose

Much more than a catchphrase, our tagline is our passion, our reason why we do what we do. This is the impact of your membership with AGCU. Learn More About Banking with a Purpose

Board of Directors Application

Board of Directors Application

Would you like to be more involved with your credit union? Do you have a strong desire to help AGCU continue to succeed and grow? If this sounds like you, we encourage you to apply for a position on the AGCU Board of Directors!

Each member of the Board of Directors is elected by the membership to serve a three-year term. These are unpaid volunteer positions. There are Two 3-year term positions up for election this year.

Applicants must be a member in good standing and at least 18 years of age. Board members are required to attend the monthly board meetings in Springfield, Missouri.

Submission instructions:

Please sign and email your completed application to: nominations@agcu.org

(If you choose, you may also include your resume with your completed application.)

Questions? Email Janelle Carlton, Executive Assistant:

Application Deadline: Wednesday, April 9, 2025

Click here to download the application

Banking With A Purpose

Much more than a catchphrase, our tagline is our passion, our reason why we do what we do. This is the impact of your membership with AGCU. Learn More About Banking with a Purpose

Is My Tax Refund Too Large?

Tax season is here, and if you’re expecting a big refund, you might be feeling like you hit the jackpot! But before you start planning how to spend that extra cash, it’s important to ask: Is my tax refund too big? Let’s break down what it means when you receive a large refund, why it may not be in your best interest, and what steps you can take to better manage your money throughout the year.