Mortgage Lenders and Credit Checks

Navigating Mortgage Lenders and Credit Checks: Your Roadmap to Informed Choices

If you need a mortgage but you’re worried about the negative effect on your credit from a credit check, remember the 45-day rule. Learn about that and more in our guide!

Q: What happens when a mortgage lender checks my credit score?

Q: What happens when a mortgage lender checks my credit score?

A: That’s a great question! Let’s explore the mortgage-shopping process, how credit checks can affect your score, and some helpful tips for choosing the right lender.

Understanding Credit Scores:

First off, what’s a credit score, and why should it matter to you?

Your credit score is a three-digit number that reflects your financial responsibility and creditworthiness. It considers factors like your payment history, credit utilization, types of credit, outstanding debt, and credit history. A higher credit score not only improves your chances of mortgage approval but also helps you secure more favorable interest rates.

Demystifying Credit Checks:

When you apply for a mortgage, the lender will likely request your credit report from one or more major credit bureaus. This process is commonly known as a credit check. The lender examines your credit report to evaluate your creditworthiness and determine whether you’re a suitable candidate for a mortgage. If any concerning red flags appear, it could lead to a higher interest rate or even a potential denial of your mortgage application.

Impact on Your Credit Score:

A credit check can have a temporary impact on your credit score. Each credit inquiry is noted on your credit report and might be viewed as a potential risk by lenders. However, the good news is that the effect is usually minor and short-lived. Your credit score typically bounces back within a few months.

Managing the Effect on Your Credit Score:

Contrary to common misconceptions, you don’t need to limit your mortgage applications out of fear of harming your credit score. Here’s the encouraging part: Multiple credit checks from mortgage lenders within a 45-day window are treated as a single inquiry on your credit report. Lenders understand that you’re in search of a single home loan, so these inquiries won’t be seen as multiple loan applications. This means you can take your time, explore various lenders, and gather loan estimates without worrying about negative consequences to your credit score.

Choosing the Right Mortgage Lender:

When seeking potential lenders, it’s always valuable to consider personal recommendations from family and friends who share your values. Additionally, you can explore online ratings and reviews of lenders to gain insights into their reputation and customer experiences. As you evaluate different options, prioritize lenders who demonstrate excellent customer service, transparent loan processes, reasonable closing costs, and fees, and offer favorable interest rates.

This knowledge will empower you as you embark on your homeownership journey. By understanding the impact of credit checks and making well-informed decisions, you can confidently select the mortgage lender that resonates with your beliefs and values.

AGCU is committed to helping you find the right home loan option for you. We offer a variety of products to meet your requirements. Whatever your lending needs are, AGCU is here to help you navigate the process.

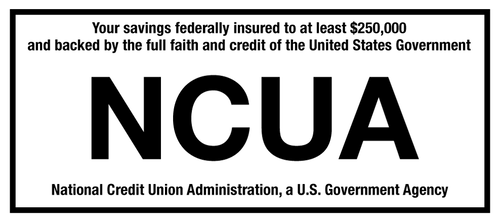

AGCU, The Secure Place To Save Your Money

AGCU, The Secure Place To Save Your Money The NCUA insures up to $250,000 per account ownership type/account type and institution. What does that mean? It gets a little complicated depending on the account types but, essentially, it means that you have at least $250,000 of protection on your deposits should the worst happen and your bank or credit union is forced to close.

The NCUA insures up to $250,000 per account ownership type/account type and institution. What does that mean? It gets a little complicated depending on the account types but, essentially, it means that you have at least $250,000 of protection on your deposits should the worst happen and your bank or credit union is forced to close.

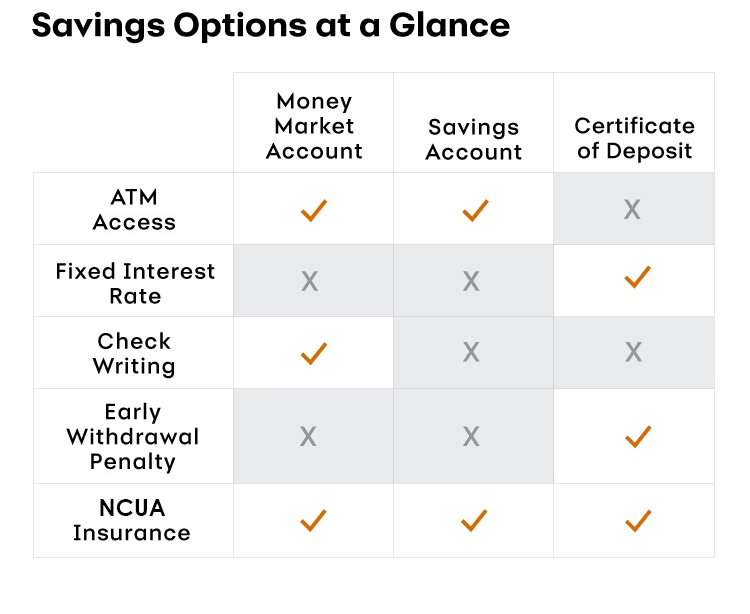

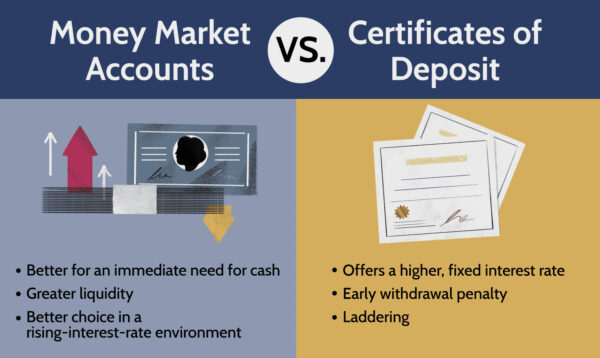

Shopping around for the best savings account can make a significant impact on your financial well-being. With inflation nibbling at our budgets, finding an account that offers decent returns has become more crucial than ever. Certificates of Deposit (CDs) and money market accounts are two alternatives to traditional savings accounts that offer higher

Shopping around for the best savings account can make a significant impact on your financial well-being. With inflation nibbling at our budgets, finding an account that offers decent returns has become more crucial than ever. Certificates of Deposit (CDs) and money market accounts are two alternatives to traditional savings accounts that offer higher