Crushing Debt: Snowball vs. Avalanche Method

Crushing Debt: Snowball vs. Avalanche Method

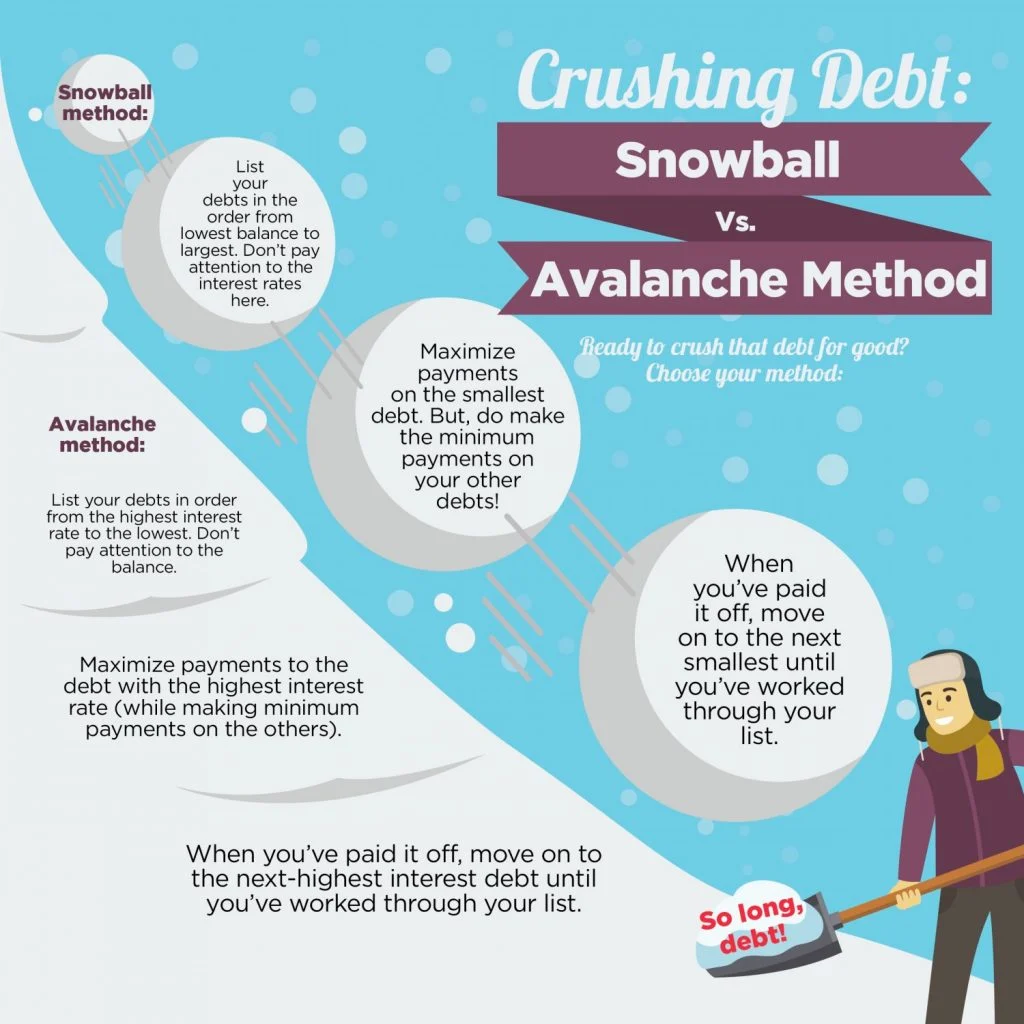

When it comes to tackling debt, there’s no one-size-fits-all solution. Two of the most popular strategies are the Snowball Method and the Avalanche Method — both effective, both widely used, but each with its own pros and cons.

So, which is better for you: the Avalanche Method or the Snowball Method? Let’s break down what each one is, how they work, and which might help you crush your debt faster and smarter.

What is the Snowball Method?

The Snowball Method focuses on paying off your smallest debt first — regardless of interest rate — while making minimum payments on all other accounts. Once that smallest debt is paid off, you roll the amount you were paying into the next smallest balance. Over time, your payments “snowball,” giving you bigger momentum as you go.

How does the Snowball Method work?

Here’s how to use the debt snowball method in action:

-

List all your debts from smallest to largest balance.

-

Pay as much as you can toward the smallest balance while making minimum payments on the rest.

-

Once the smallest is gone, roll that payment into the next debt.

-

Keep going until you’re debt-free!

This strategy is ideal for people who are motivated by quick wins and want to build confidence by seeing progress fast.

What is the Avalanche Method?

The Avalanche Method takes a more mathematical approach. You prioritize paying off debts with the highest interest rate first, regardless of balance. This method saves you the most money over time because you reduce interest payments faster.

How does the Avalanche Method work?

Using the avalanche method for debt, here’s what you do:

-

List your debts by interest rate — highest to lowest.

-

Pay as much as possible toward the highest-rate debt while making minimum payments on the others.

-

Once the high-interest debt is gone, move on to the next highest.

-

Repeat until you’re debt-free.

If you’re focused on saving money in the long run, the avalanche method may be your best bet.

Avalanche Method vs. Snowball Method: Which Should You Choose?

When comparing the snowball vs. avalanche method, it comes down to psychology vs. mathematics.

-

The Snowball Method is best if you need motivation and like quick wins to stay on track.

-

The Avalanche Method is ideal if you’re focused on paying less interest and getting out of debt faster overall.

The debt snowball vs. avalanche debate has passionate supporters on both sides — but the truth is, either method is better than doing nothing. Pick the one that fits your personality and financial goals.

Disadvantage of the High-Rate (Avalanche) Method

One disadvantage of the avalanche method is that it can take longer to feel like you’re making progress — especially if your highest-interest debt is also your largest. That can lead to frustration or burnout before you see a win.

In contrast, the debt snowball method gives you early momentum, but may cost more in interest if your small debts have low rates.

Need Help Choosing Snowball or Avalanche? AGCU Can Help

At AGCU, we know that navigating debt can feel overwhelming. Whether you’re using the snowball or avalanche method, our team is here to help you build a strategy that works.

💡 Ask us about:

-

Debt Consolidation Loans to simplify payments

-

Low-Rate Credit Cards to reduce interest

-

Budgeting Tools through our Online Banking

Final Thoughts: Avalanche vs. Snowball — Just Start

The key to success isn’t which method you choose — it’s that you choose a method and start making progress. Whether it’s the snowball vs avalanche method, the important thing is to be intentional, stay consistent, and keep your eyes on a debt-free future.

Want help getting started? Contact AGCU today and let’s crush your debt — together.

Banking With A Purpose

Much more than a catchphrase, our tagline is our passion, our reason why we do what we do. This is the impact of your membership with AGCU. Learn More About Banking with a Purpose

In order to be a part of our giveaway, each contestant puts their contact information into a survey,

In order to be a part of our giveaway, each contestant puts their contact information into a survey, On July 30, 2021, The family of Christopher Hill, Director of Computer Applications and Development at General Council of the Assemblies of God, sustained a great loss.

On July 30, 2021, The family of Christopher Hill, Director of Computer Applications and Development at General Council of the Assemblies of God, sustained a great loss.

If you’re looking to purchase an ATV, you’ll first need to choose between the two main categories for these vehicles: utility and sport. Utility ATVs have larger tires, are generally easier to ride and have fewer bells and whistles than sport ATVs. As their name implies, utility ATVs are designed for work (though they still deliver a fun ride), while sport ATVs are more commonly used for recreational purposes only. Prices for each can run from as low as just a few thousand dollars to a whopping $65,000 for a luxury, fully loaded vehicle.

If you’re looking to purchase an ATV, you’ll first need to choose between the two main categories for these vehicles: utility and sport. Utility ATVs have larger tires, are generally easier to ride and have fewer bells and whistles than sport ATVs. As their name implies, utility ATVs are designed for work (though they still deliver a fun ride), while sport ATVs are more commonly used for recreational purposes only. Prices for each can run from as low as just a few thousand dollars to a whopping $65,000 for a luxury, fully loaded vehicle. You could save up to 2% on your next auto, motorcycle, RV, or watercraft loan.* This includes NEW & USED vehicles.

You could save up to 2% on your next auto, motorcycle, RV, or watercraft loan.* This includes NEW & USED vehicles.

AGCU is proud to have again earned Bauer Financial, Inc.’s highest rating for strength and stability among all financial institutions.

AGCU is proud to have again earned Bauer Financial, Inc.’s highest rating for strength and stability among all financial institutions.