Seize the Opportunity: Why Now is the Perfect Time to Open a Share Certificate (CD)

Seize the Opportunity: Why Now is the Perfect Time to Open a Share Certificate (CD)

Are you looking for a secure and rewarding way to grow your savings? Look no further! Opening a Share Certificate, also known as a Certificate of Deposit (CD), can be a smart financial move, especially in today’s economic climate. Let’s delve into the key reasons why now is the perfect time to embrace the benefits of a Share Certificate.

Secure and Guaranteed Returns:

Share Certificates are a low-risk investment option offered by credit unions and banks. Unlike traditional savings accounts, Share Certificates offer fixed interest rates over a set period, usually ranging from a few months to several years. This means you can lock in your interest rate at the time of purchase, ensuring guaranteed returns on your investment.

Protection Against Market Volatility:

With economic uncertainties and market fluctuations, it’s natural to seek stability in your financial decisions. Share Certificates provide a safe haven for your money, shielding it from market ups and downs. Your funds will be secure, regardless of what happens in the financial landscape.

Higher Interest Rates:

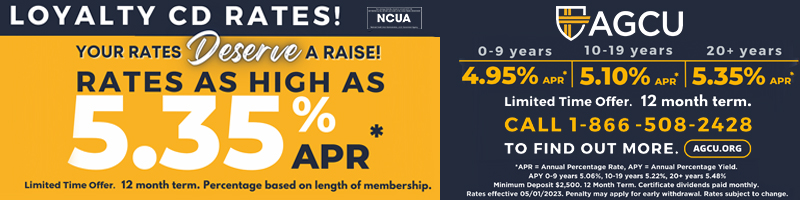

Currently, many financial institutions are offering competitive interest rates on Share Certificates. These rates are often higher than what you would earn in a regular savings account, allowing you to maximize your returns without taking on additional risks.

Diverse Term Options:

Share Certificates come with a variety of term options to suit your specific financial goals. Whether you prefer short-term investments or long-term planning, you can find a Share Certificate that aligns perfectly with your needs. Check here for more information about rates and terms.

Flexible Terms for Optimal Control:

While Share Certificates are known for their fixed terms, some institutions offer flexible options. For example, you might find penalty-free early withdrawal or the ability to ladder your Share Certificates to take advantage of varying interest rates and maturity dates.

Reinforcing Financial Discipline:

By committing your funds to a Share Certificate for a set period, you encourage financial discipline and discourage impulsive spending. This proactive approach to savings fosters a healthy financial mindset and encourages long-term planning.

Insured and Protected:

Just like other deposit accounts, Share Certificates are insured by the National Credit Union Administration (NCUA) up to $250,000. This added layer of protection ensures the safety of your investment.

Opening a Share Certificate is a wise and timely decision for securing your financial future. With guaranteed returns, protection against market volatility, and higher interest rates, Share Certificates offer an attractive investment option. Take advantage of the diverse term options and flexible terms to find the perfect fit for your financial goals. Embrace the opportunity to grow your savings with confidence and peace of mind. Open a Share Certificate today and pave the way for a financially rewarding tomorrow!