Banks vs. Credit Unions: What’s the Difference and Why AGCU Might Be Right for You!

When it comes to managing your finances, choosing the right financial institution can make a world of difference. Both banks and credit unions offer similar services, like checking and savings accounts, loans, and online banking. However, their structures, goals, and the benefits they provide set them apart. Let’s dive into what makes them different—and why AGCU might be your ideal choice.

Banks vs. Credit Unions: Key Differences

Ownership and Purpose

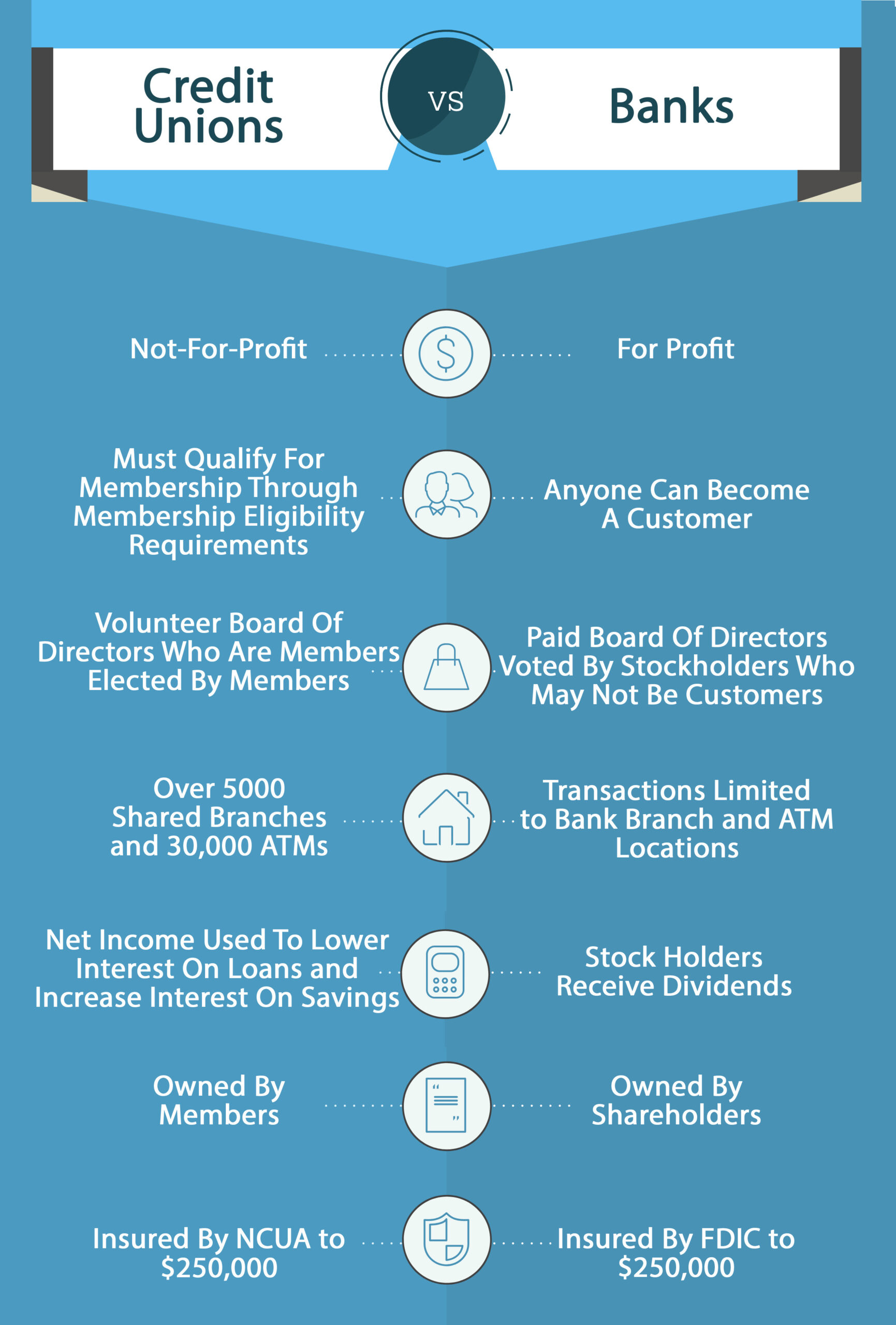

Banks are for-profit institutions owned by shareholders. Their primary goal is to generate profit, which is returned to shareholders as dividends. In contrast, credit unions are not-for-profit organizations owned by their members. This means that when you join a credit union, you’re not just a customer but an owner. You can attend annual meetings, vote on credit union board members, and help guide the direction of the credit union.

While anyone can open an account with a bank, credit unions typically have specific membership requirements. Qualifications vary but are generally based on factors like where you live, work, worship, or your association with a particular organization.

As a credit union, AGCU is committed to serving our members and the Assemblies of God by offering tailored financial solutions that reflect our shared faith and community values. When you bank with us, you support a financial institution that shares your values and helps build the Kingdom of God.

At AGCU, every decision is made with members in mind, not shareholders. Our mission is to help you manage your finances to align with your faith and values.

How Profits Are Used

Since banks operate as for-profit entities, their income often goes toward paying taxes, expanding operations, or rewarding shareholders. On the other hand, credit unions reinvest their earnings into member benefits like lower interest rates on loans, higher rates on savings accounts, and reduced fees.

For AGCU members, this translates into financial advantages like affordable loan options, competitive savings rates, and resources designed to support ministries, families, and individuals alike. But more importantly, when you use AGCU for your day-to-day banking needs, you support worthy causes, both where you live and worldwide.

We donate 10% of our annual earnings to support churches, ministries, educational scholarships and programs, and humanitarian efforts each year.

Every day, we provide vital financial services to people, ministries, and businesses throughout the United States. We also support missionaries in 190 countries around the world.

Convenience Without Compromise

Big banks often focus on scale and efficiency. While they have great online and mobile technology, many customer transactions are limited to their specific bank branches and ATM locations.

Credit unions typically have fewer physical branches, so they make up for it with shared branch networks and robust digital tools. AGCU members enjoy access to over 5,000 shared branches and 30,000 surcharge-free ATMs nationwide through the CO-OP Shared Branch Network, along with user-friendly online, mobile, and video banking. You’ll always have access to your accounts when you need it.

Lower Fees and Better Rates

Credit unions are known for their lower fees and competitive rates. Whether it’s a loan for a new car, a mortgage, or a savings account, you’re likely to find better deals at a credit union.

Are Credit Unions Safer Than Banks?

Federally insured credit unions and banks are both safe places to keep your money. Money kept in banks is insured by the FDIC. And federally insured credit unions offer NCUA insurance. Both are federal insurance backed by the U.S. government. Both offer protection up to $250,000 per account.

AGCU: More Than Just a Credit Union

At AGCU, we’re more than a financial institution. We’re a ministry partner, here to help you live out your Kingdom calling. From checking and savings accounts to loans and digital banking, we offer a full suite of financial services tailored to your needs.

When you bank with AGCU, you’re not just making a wise financial choice but investing in a mission-driven organization that shares your faith and values. It’s Banking with a Purpose.

Why Choose AGCU?

To decide if a bank or a credit union is better for you, you’ll need to identify what’s important to you and how each type of financial institution matches your priorities.

At AGCU, we offer a comprehensive range of financial services to meet the needs of our members. Whether you’re managing your family’s finances, leading a church, or running a small business, we have the tools and resources to help you achieve your goals.

Making the Switch

If you’re looking for lower fees, personalized service, and a financial partner who truly understands your values, a credit union like AGCU might be the perfect fit.

Ready to experience the difference? Call us today at 417-831-4398 , Apply online, Begin a Video Call or Stop by one of our branches to learn more about becoming a member today. Together, we can build a better financial future rooted in faith, community, and trust.