Now is the Time to Refinance

Now Is The Time To Refinance

Cash Out Refi

|

||

|

||

|

||

|

||

|

||

|

Visit our Home Loan Center to get started!

AGCU is committed to helping find the right home loan option for you. We offer a variety of products to meet your requirements. Whatever your lending needs are, AGCU is here to help you navigate the process.

Have a question or want to get started with an application? Connect with an AGCU Video Banking Representative or apply online today!

Speak face-to-face with an AGCU Video Banking Representative from anywhere.

Give it a try today! Video Banking Hours (CST): Mon – Fri: 8:30 a.m.- 5:00 p.m.

Contact a Mortgage Officer

Apply now, or contact our mortgage professionals at 866-508-2428, email us for more information, or complete the form below and we will contact you.

1 CoreLogic, Homeowner Equity Insights report, data through Q3 2021.

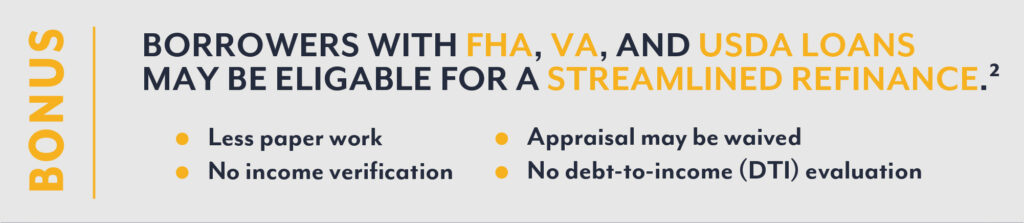

2 The Mortgage Reports, “The Streamline Refinance: Get Today’s Low Rates With Almost No Paperwork,” February 28, 2020.