Savings Account vs. CD vs. Money Market Account: Which is Right for You?

Shopping around for the best savings account can make a significant impact on your financial well-being. With inflation nibbling at our budgets, finding an account that offers decent returns has become more crucial than ever. Certificates of Deposit (CDs) and money market accounts are two alternatives to traditional savings accounts that offer higher interest rates with minimal risk. But how do you choose between them? Let’s explore the factors to consider and help you decide which option best suits your needs.

Shopping around for the best savings account can make a significant impact on your financial well-being. With inflation nibbling at our budgets, finding an account that offers decent returns has become more crucial than ever. Certificates of Deposit (CDs) and money market accounts are two alternatives to traditional savings accounts that offer higher interest rates with minimal risk. But how do you choose between them? Let’s explore the factors to consider and help you decide which option best suits your needs.

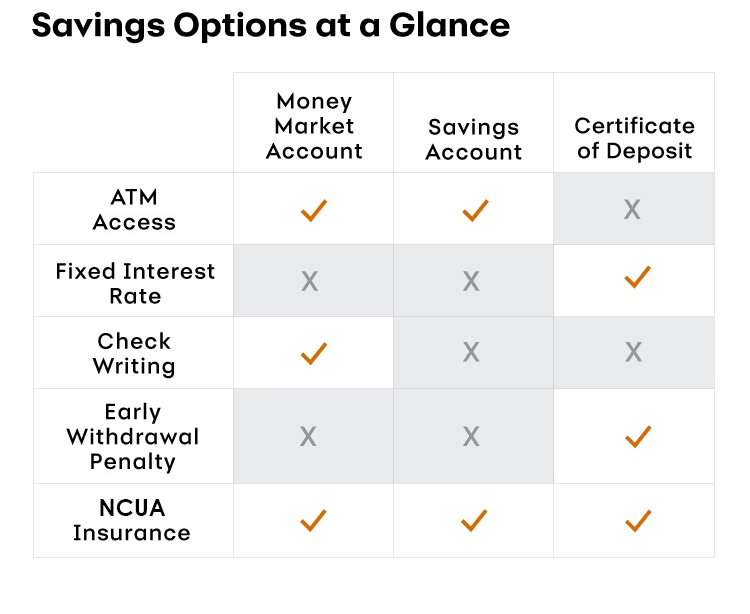

CDs and money market accounts offer competitive interest rates with low risk, but they serve different purposes based on your financial goals and needs.

CDs: Locking in Returns for a Fixed Term

A Certificate of Deposit (CD) operates as a time-bound investment where you deposit a lump sum for a fixed term, typically ranging from three months to five years. In exchange, you receive a fixed interest rate, and at the end of the term, you get back your initial deposit plus the accumulated interest. CDs are NCUA-insured and do not lose value, making them a safe investment option.

Pros and Cons of CDs:

Pros:

- Higher interest rates compared to regular savings accounts.

- Certainty of returns; you know exactly how much you’ll earn and when.

- Safety and security; CDs are NCUA-insured and do not lose value.

Cons:

- Early withdrawal penalties may apply if you need access to funds before the CD matures.

- Opportunity cost if interest rates rise during the CD term.

- Long-term returns may be lower compared to diversified investment portfolios.

Money Market Accounts: Balancing Flexibility with Returns

A money market account blends features of both checking and savings accounts. You can deposit and withdraw funds as needed, typically via checks or a debit card. Money market accounts offer higher interest rates than regular savings accounts, making them an attractive option for savers looking to earn more while maintaining access to their funds.

Pros and Cons of Money Market Accounts:

Pros:

- Competitive interest rates higher than regular savings accounts.

- Flexibility to access funds easily through checks or debit cards.

- NCUA-insured, ensuring the safety of your deposits.

Cons:

- Minimum balance requirements may be higher than regular checking accounts.

- Withdrawal limitations on number of transactions per month.

- Potential fees for falling below the minimum balance or exceeding withdrawal limits.

Choosing Between a CD and Money Market Account: Consider Your Needs

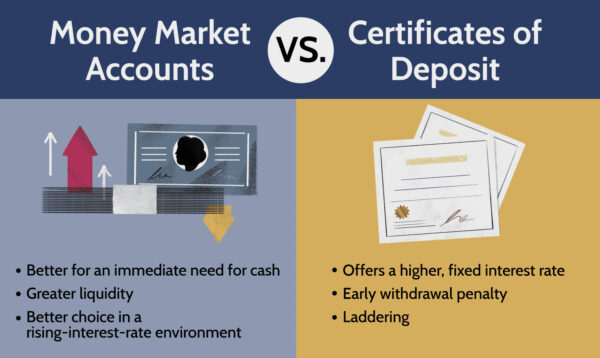

Deciding between a CD and a money market account boils down to your financial goals and timeline. Here’s when each option might be more suitable:

When a Money Market Account Might Be a Better Choice:

- You prioritize flexibility and need access to your funds for unexpected expenses or emergencies.

- You want to continue making contributions to your savings over time.

- You maintain a sufficient balance to meet minimum requirements and maximize interest earnings.

When a CD Might Be a Better Choice:

- You have a lump sum of money that you won’t need access to for a fixed period.

- You have a specific financial goal with a defined timeline, such as saving for a down payment or a future expense.

- You anticipate a decline in interest rates and want to lock in a higher fixed rate for guaranteed returns.

In Conclusion:

CDs and money market accounts offer safe and reliable ways to earn higher interest on your savings. Choosing between them depends on your individual financial circumstances, goals, and need for access to funds. By evaluating the pros and cons of each option and considering your long-term objectives, you can make an informed decision that aligns with your financial strategy and helps you achieve your savings goals effectively. Contact Member Care to Open a CD or Money Market Account Today!

Start a Video Banking Call or apply through an online application.

Speak face-to-face with an AGCU Video Banking Representative from anywhere.

Give it a try today! Video Banking Hours (CST): Mon – Fri: 9:00 a.m.- 5:00 p.m.

Apply through online application.

Do you have questions regarding becoming a member or opening an account? Call (417) 831-4398 or fill out our contact form and we will contact you!