Don’t Get Scammed!

Here are some tips to help avoid scams and protect your personal information

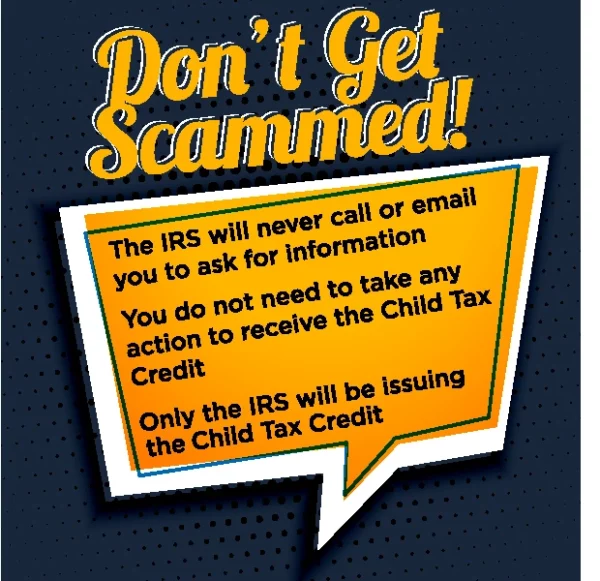

Child Tax Credit payments begin this month, and scammers are using this as an opportunity to try to trick you out of your personal information. These tips from the IRS can help to keep yourself safe from potential scams.

The IRS has launched Identity Theft Central, an online resource that explains how to report identity theft and protect yourself from online scams and phishing attacks. (Phishing emails, calls, texts, and letters try to trick you into sending cash or disclosing personal information. Some phishing attacks aim to let a fraudster infiltrate your computer and steal information). The site also contains information for businesses and tax professionals.

10 Ways to Spot IRS Scams and Impersonators

It is true that in rare circumstances the IRS will call or come to a home or business. According to the agency, that might happen if you have an overdue tax bill, haven’t filed a tax return, haven’t paid payroll taxes on your employees, or are undergoing an audit or criminal investigation.

But even then, taxpayers generally first receive several letters or notices from the IRS in the mail, and taxpayers will only be asked to pay the U.S. Treasury. Which is why the items below are major red flags that IRS scams are lurking.

- They’re calling you first.

The IRS contacts taxpayers by mail first; it doesn’t initiate contact via a random phone call. - They’re leaving a prerecorded voice mail.

The IRS doesn’t leave prerecorded, urgent, or threatening voicemails. - They’re emailing you.

The IRS doesn’t initiate contact with taxpayers by email to request personal or financial information. Do not reply to the message, open any attachments or click on any links. And note that the IRS’s website is IRS.gov — not IRS.com, IRS.net, IRS.org or some other bit after the period. - They’re texting you.

The IRS doesn’t initiate contact with taxpayers by text message to request personal or financial information. - They’re contacting you via social media.

The IRS doesn’t initiate contact with taxpayers on social media channels to request personal or financial information. - The form they’re sending or referencing doesn’t appear on the IRS website.

You can look up the names of IRS notices and letters on the IRS website. If the type of notice you received doesn’t show up on the list, it’s probably not legit. - They don’t know what an HSPD-12 card is.

Real IRS agents have two forms of identification: a pocket commission and an HSPD-12 card. You have the right to see these credentials, and you can verify information on the HSPD-12 card by calling the IRS. - They’re asking for a credit card or debit card number over the phone.

The IRS doesn’t do that. - They want you to pay only with gift cards, iTunes cards or prepaid debit cards.

The IRS doesn’t use these methods for tax payments. The IRS mails paper bills to taxpayers who owe taxes, and payment should only ever be made out to the U.S. Treasury — not a collections agency or other entity. - They’re saying you’ll be arrested, deported, have your driver’s license revoked, etc.

The IRS can’t revoke your driver’s license, business licenses, or immigration status. In addition, the IRS and the Taxpayer Bill of Rights give you the opportunity to question or appeal what the IRS says you owe.

But what if I really do owe the IRS money?

If you think you might owe money to the IRS, you can check that directly with the IRS (and for free) by visiting https://www.irs.gov/payments/view-your-tax-account. If you do owe back taxes and want to make a payment, you can send money directly the IRS or sign up for an installment plan to pay the IRS over time. All of those things you can do yourself directly with the IRS.

Fight back: How to report IRS scams

- Tell the Treasury Inspector General for Tax Administration (TIGTA). You can report IRS scams online or by calling TIGTA at 1-800-366-4484.

- Forward email messages that claim to be from the IRS to phishing@irs.gov. Do not open the attachments or click on any links in those emails.

- Tell the Federal Trade Commission via the FTC Complaint Assistant on FTC.gov. Add “IRS Telephone Scam” in the notes.

- Report Social Security Administration phone impostor scams using the form on the Social Security Administration’s website.

- If the IRS scams appear to be impersonating a state tax authority rather than the IRS, contact your state Attorney General’s office.

- Contact AGCU Member Services with any questions you may have about your account.

Banking With A Purpose

Much more than a catchphrase, our tagline is our passion, our reason why we do what we do. This is the impact of your membership with AGCU. Learn More About Banking with a Purpose