7 Signs You’re Living Beyond Your Means and How to Fix Them – Healthy Finances

Let’s take a look at seven red flags that might mean you’re living beyond your means and the steps you can take to get back on track.

You’re carrying a credit card balance from month-to-month

If you have a large credit card balance and just pay the minimum each month, you could end up carrying this balance for years while paying a lot in interest. You might also be tempted to make more purchases on the card, ultimately increasing the time it takes to pay off the debt.

You might consider: Try to double down on your monthly payments and/or make one extra payment each month instead of paying just the minimum amount. If you have multiple credit cards with high-interest rates, consider transferring all your balances to one credit card with a lower interest rate.

AGCU offers a variety of personal credit cards, including Max Cash Preferred, Real Rewards, Platinum, and Secured Card. Pick the card best suited for your needs!

Paying your bills gives you anxiety

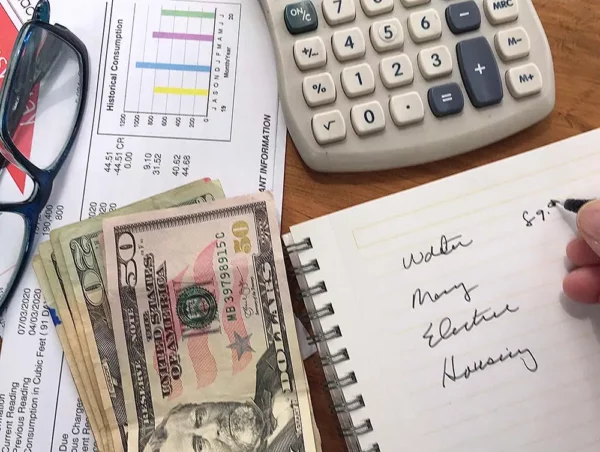

Paying your bills gives you anxiety

Does the thought of making your monthly bill payments on time fill you with dread? Having a plan upfront can help decrease your stress and empower you to control your finances.

You might consider: Making a monthly budget, detailing your income and spending. Look for areas to cut back on “discretionary” purchases and consider ways to boost your income. Our budgeting tools are a great way to keep on target!

Log in to your Online Banking Account and select the My Finance tab to start taking control of your spending today!

You can’t save 5% of your monthly income

Putting away at least 5% of your income could help you pay for seasonal expenses like vacations, back to school, or holidays, without relying on credit.

You might consider: Trimming your expenses and restructure your budget to include at least 5% for savings. If this amount is not feasible, start with 1-2% and gradually increase each month until you can reach 5%.

You don’t have emergency or rainy-day funds

Ideally, you should have an emergency fund to cover urgent needs that you can’t anticipate. According to a recent Bankrate survey, “just 40% of Americans could pay an unexpected $1,000 expense, such as an emergency room visit or car repair, with their savings”.

You might consider: Starting to build your funds now by putting away as much as you can each month, specifically for emergencies. Consider setting up automatic recurring transfers into one of your AGCU savings accounts to help prepare now for the unexpected.

Your mortgage payment is more than 30% of your monthly income

Most financial experts agree that your monthly mortgage payment should not exceed 30% of your take-home pay.

You might consider:

- Finding ways to boost your income. Seek a raise at your current job, freelance for hire, or find another side job for extra cash.

- Spending less on another home or consider renting.

- Refinancing your existing loan could be an option. Call or visit your local branch to speak with an AGCU representative to explore your options. Visit our Home Loan Center to get started!

Can you afford to purchase or refinance your leased vehicle?

If the answer is no, this could spell financial trouble.

You might consider: Finding a less expensive vehicle to purchase. AGCU has lower interest rates and more flexible options than many other auto loan providers. Learn more!

Your financial decisions are influenced by your friends’ spending habits

Thanks to social media, the pressure of “keeping up with the Joneses” is stronger than ever. If you find yourself making financial decisions based on your friends’ choices, you could be spending more than you can afford.

You might consider: Not feeling compelled to live up to the expectations of others. The peace of mind you gain by taking control of your finances contributes more to your well-being in the long run.

If you’re feeling overwhelmed by your current financial situation, we might be able to help. Stop by your local branch or call 866-508-AGCU (2428) for assistance.

Banking With A Purpose

Much more than a catchphrase, our tagline is our passion, our reason why we do what we do. This is the impact of your membership with AGCU. Learn More About Banking with a Purpose