12 Steps to Financial Freedom: STEP 9Build and Maintain an Excellent Credit score

Your credit score is vital to your financial health. This number measures your money management skills, credit capacity, and fiscal responsibility. An excellent credit score can open the door to large loans with better interest rates, as well as employment opportunities and more.

Let’s explore the best ways to build and maintain an excellent credit score.

Have several active credit cards

Building and preserving a healthy credit score requires owning a few cards and keeping them active. If you’re just starting out, consider signing up for a beginner’s card, which generally features easy eligibility requirements and very little available credit. Otherwise, have a minimum of three open cards that you use wisely on a regular basis. AGCU offers a variety of personal credit cards, including Max Cash Preferred, Real Rewards, Platinum, and Secured Card. Pick the card best suited for your needs!

Work on paying down debt

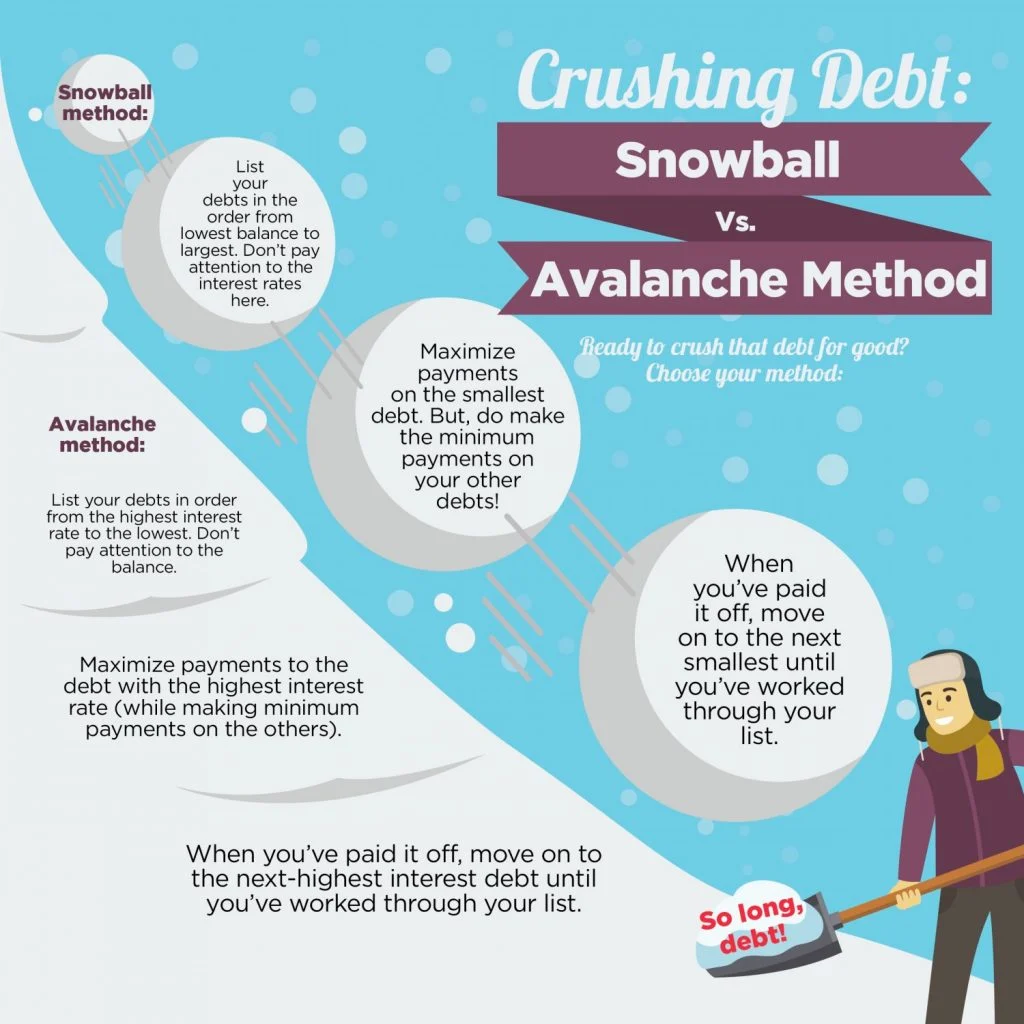

First, choose your debt-crushing method: The snowball method works by putting all available funds toward paying off the lowest debt first and then the next smallest, until all debts are paid off. The avalanche method works the same way but focuses on paying off the highest interest rate debts in descending order until all are paid off. With the snowball method, you’ll get faster results but may end up paying more in overall interest payments on all debts. Showing the credit bureaus that you’re on track to pay off your debt can do wonders for your score.

Pay your bills on time

Paying credit card bills when, or before, they’re due is a major factor in your score. Continually carrying an outstanding balance and/or owing lots of interest shows that you can’t be counted on to repay loans responsibly. Remember, you can set up automatic monthly payments with AGCU Bill Pay, so you’re always on time.

Bring down your credit utilization ratio

Another crucial factor in your score is your credit utilization ratio. This refers to the amount of available credit you use. Keep your utilization under 30% or even 10% if you can. To that end, make sure you’re using just a bit of your available credit each month. In addition, consider accepting offers for increased credit – as long as you know you won’t rack up huge bills simply because of having all that credit.

Use the tips outlined here to build and maintain a great score.

Read Step 1: How to Track Your Spending

Read Step 2: Creating a Budget

Read Step 4: Have the Money Talk With Your Partner

Read Step 5: Practice Mindful Spending

Read Step 7: How to Pay Yourself First

Read Step 8: Know When and How to Indulge

Read Step 9: Build and Maintain an Excellent Credit Score

Read Step 10: Plan for Retirement

Read Step 12: Review and Tweak

Banking With A Purpose

Much more than a catchphrase, our tagline is our passion, our reason why we do what we do. This is the impact of your membership with AGCU.

Learn More About Banking with a Purpose