What is a CD And How Do They Work?

What Is a Certificate of Deposit And How Do They Work?

With so many financial products available, choosing which type of account to open can be just as stressful as deciding where to open one. For consumers looking for earnings on their savings, one of the options that AGCU offers is share certificates. Here’s a brief overview of how they work and some of their advantages and disadvantages.

Jump To:

- How CDs Work

- How Terms, Minimum Balances and Rates Interact

- Compounding interest: Interest Rate vs. APY

- Choosing a CD

- Building a CD Ladder

- Combining CDs With Other Accounts

A certificate of deposit (CD) is a low-risk savings tool that can boost the amount you earn in interest while keeping your money invested in a relatively safe way.

Like savings accounts, CDs are considered low risk because they are FDIC-insured up to $250,000. However, CDs generally allow your savings to grow at a faster rate than they would in a savings account.

How CDs Work

In exchange for depositing your money into a bank for a fixed period (usually called the term or duration), the bank pays a fixed interest rate that’s typically higher than the rates offered on savings accounts. When the term is up (or when the CD matures), you get back the money you deposited (the principal) plus any interest that has accrued.

If you need to access your funds before the CD’s term ends, you are subject to an early withdrawal penalty, which can significantly reduce the interest you earned on the CD.

Tip: Before opening a CD, make sure you have an emergency fund—a comfortable amount of savings in an easily accessible account, such as a savings account.

How Terms, Minimum Balances and Rates Interact

CDs come in varying terms and may require different minimum balances. The rate you earn typically varies by the term and how much money is in the account. In general, the longer the term and the more money you deposit, the higher the rate you are offered. (A longer term does not necessarily require a larger minimum balance.)

Compounding interest: Interest Rate vs. APY

Like savings accounts, CDs earn compound interest—meaning that periodically, the interest you earn is added to your principal. Then that new total amount earns interest of its own, and so on.

Because of the compound interest, it is important to understand the difference between interest rate and annual percentage yield (APY). The interest rate represents the fixed interest rate you receive, while APY refers to the amount you earn in one year, taking compound interest into account.

Choosing the Right CD For You

There are a number of factors to consider when choosing a CD. First, when do you need the money? If you need it soon, consider a CD with a shorter term. But if you’re saving for something five years down the line, a CD with a longer term and higher rate may be more beneficial. Check CD Rates Here

Also, consider the economic environment. If it seems that interest rates may rise, or if you want to open multiple CDs, CD laddering can be a good option.

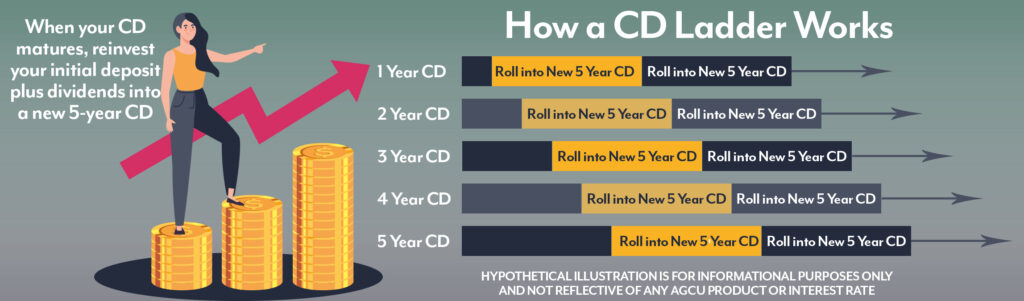

Building a CD Ladder

Overall interest rates may change during your CD’s term. If rates rise, you miss out on earning those higher rates, since your money is committed for the CD’s term. However, if rates go down, you benefit: You still earn the higher rate that was offered when you opened the CD. CD laddering, buying multiple CDs of varying term lengths, can help address this concern.

It can also be a way for you to take advantage of longer terms (and therefore higher interest rates) while still giving you access to some of your money each year.

With a CD ladder, you divide your initial investment into equal parts and invest each portion in a CD that matures every year. For example, say Leo has $10,000. To build a CD ladder, he invests $2,000 each in a 1-year, 2-year, 3-year, 4-year and 5-year CD. As each CD matures, he reinvests the money at the current interest rate or uses the cash for another purpose. If Leo reinvests his money, he might choose a new 5-year CD, which would ensure he has one CD maturing each year as long as he continues laddering.

Combining CDs With Other Accounts

Be sure to consider other options for saving or investing your funds. Diverse accounts offer different levels of risk and return. Learn about AGCU CD Rates and get started today!