Protect Yourself From Scammers

Wire transfers are a fast and convenient way to send money, but they also make an easy target for scammers. Fraudsters often trick victims into sending funds, knowing that once the money is gone, it’s nearly impossible to recover. Protect yourself by learning how to spot wire transfer scams and what steps to take if you’re targeted.

🚨 Quick Protection Tips – Don’t Fall for a Wire Transfer Scam!

🔹 Verify Before You Transfer – Always confirm the recipient’s identity before sending money.

🔹 Look for Red Flags – Scammers often pressure you to act fast or send money secretly.

🔹 Avoid Unsolicited Requests – Be cautious if someone asks for a wire transfer out of the blue.

🔹 Use Secure Payment Methods – Credit cards or bank transfers with fraud protection are safer than wires.

🔹 Report Suspicious Activity – If something feels off, contact AGCU immediately.

👉 Want details? Jump to the full list of protection tips below! #ProtectionTips

Common Wire Transfer Scams to Watch Out For

Fraudsters are always finding new ways to trick people. Here are some of the most common wire transfer scams:

1. Impersonation Scams

A scammer pretends to be someone you trust—your bank, a government agency, or even a loved one in trouble. They may claim:

✅ You owe taxes or legal fees

✅ A family member is in urgent need of help

✅ Your bank account has been compromised and needs immediate action

⛔ Warning Sign: They ask you to wire money quickly to resolve the issue.

💡 Protect Yourself: Contact the person or institution directly using an official phone number.

2. Online Purchase Scams

You find a great deal on a car, apartment, or puppy—but the seller insists on a wire transfer before delivering the item.

⛔ Warning Sign: They refuse to accept other payment methods or won’t let you see the item in person.

💡 Protect Yourself: Only buy from trusted sources and use payment methods that offer fraud protection.

3. Employment & Fake Check Scams

You’re offered a job or prize, but they send a check and ask you to wire back part of the money. Later, the check bounces, and you’re left owing the full amount.

⛔ Warning Sign: If it sounds too good to be true, it probably is.

💡 Protect Yourself: Never wire money to a stranger, especially for a job or prize you didn’t apply for.

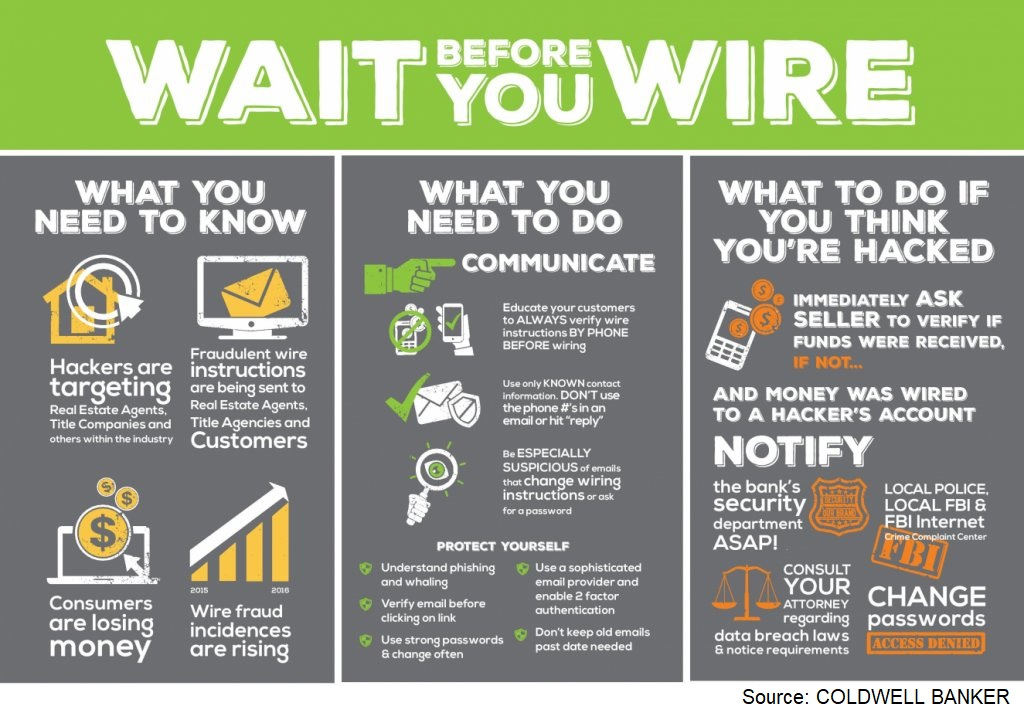

4. Real Estate & Title Fraud

Scammers trick homebuyers or sellers into wiring closing costs to a fraudulent account.

⛔ Warning Sign: You receive last-minute payment instructions via email or phone.

💡 Protect Yourself: Always verify payment details directly with your title company or real estate agent.

🔐 How to Protect Yourself from Wire Transfer Fraud

Follow these steps to keep your money safe:

✅ Think Before You Wire – Once a wire transfer is sent, it’s nearly impossible to reverse. Always double-check.

✅ Verify Directly – If you receive an unexpected request, call the person or company using a known phone number.

✅ Trust Your Gut – Scammers pressure you to act fast. Take your time to verify the situation.

✅ Use Secure Payment Methods – If a seller only accepts wire transfers, consider it a red flag.

✅ Stay Educated – Learn about new fraud tactics so you can spot them early.

🚨 If you suspect fraud, contact AGCU immediately! Our team can help protect your account and prevent unauthorized transactions.

📞 Report fraud now: [Insert AGCU fraud hotline or contact page link]

🛑 What to Do If You’re Targeted by a Wire Transfer Scam

If you’ve already sent a wire transfer and suspect fraud:

1️⃣ Contact Your Bank Immediately – The faster you act, the better chance you have of stopping the transaction.

2️⃣ Report the Scam – File a complaint with the Federal Trade Commission (FTC) at ReportFraud.ftc.gov.

3️⃣ Warn Others – Share your experience to prevent others from falling victim.

Stay Safe with AGCU

At AGCU, we’re committed to protecting our members from fraud. We offer secure banking options, fraud alerts, and expert guidance to help you keep your money safe.

💡 Want to learn more about fraud prevention? Explore our Security Center for tips and resources.

📢 Have you encountered a suspicious request? Let us know! Contact AGCU today.